| Zacks Company Profile for Flexsteel Industries, Inc. (FLXS : NSDQ) |

|

|

| |

| • Company Description |

| Flexsteel Industries Inc. is engaged in the design, manufacture and sale of a broad line of quality upholstered furniture for residential, commercial, and recreational vehicle seating use. Flexsteel primarily distributes its products throughout most of the United States through their sales force to furniture dealers, department stores, recreational vehicle manufacturers and van converters, and hospitality and healthcarefacilities. The products are also sold to several national chains, some of which sell on a private label basis.

Number of Employees: 1,400 |

|

|

| |

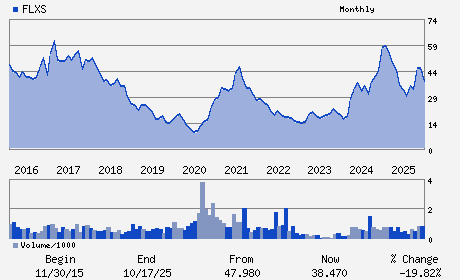

| • Price / Volume Information |

| Yesterday's Closing Price: $50.33 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 49,006 shares |

| Shares Outstanding: 5.35 (millions) |

| Market Capitalization: $269.04 (millions) |

| Beta: 0.47 |

| 52 Week High: $59.95 |

| 52 Week Low: $29.38 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

20.81% |

22.48% |

| 12 Week |

25.70% |

25.06% |

| Year To Date |

27.45% |

26.78% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Derek P. Schmidt - Chief Executive Officer and Director

Thomas M. Levine - Chairman

Michael J. Ressler - Chief Financial Officer

William S. Creekmuir - Director

F. Brooks Bertsch - Director

|

|

Peer Information

Flexsteel Industries, Inc. (DMIF.)

Flexsteel Industries, Inc. (NCL)

Flexsteel Industries, Inc. (FCPR)

Flexsteel Industries, Inc. (AMWD)

Flexsteel Industries, Inc. (SNBR)

Flexsteel Industries, Inc. (MLKN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FURNITURE

Sector: Consumer Discretionary

CUSIP: 339382103

SIC: 2510

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/20/26

|

|

Share - Related Items

Shares Outstanding: 5.35

Most Recent Split Date: 12.00 (1.50:1)

Beta: 0.47

Market Capitalization: $269.04 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.59% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.80 |

Indicated Annual Dividend: $0.80 |

| Current Fiscal Year EPS Consensus Estimate: $4.09 |

Payout Ratio: 0.16 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: -0.36 |

| Estmated Long-Term EPS Growth Rate: 12.00% |

Last Dividend Paid: 12/29/2025 - $0.20 |

| Next EPS Report Date: 04/20/26 |

|

|

|

| |