| Zacks Company Profile for F.N.B. Corporation (FNB : NYSE) |

|

|

| |

| • Company Description |

| F.N.B. Corporation is a financial holding company. It offers commercial banking solutions, consumer banking products and services, and wealth management services through its subsidiary network, which is led by its largest affiliate, First National Bank of Pennsylvania. It operates through three reportable segments: Community Banking provides commercial and consumer banking services. Commercial banking solutions include corporate banking, small business banking, investment real estate financing, business credit, capital markets and lease financing. Consumer banking products and services consist of deposit products, mortgage lending, consumer lending and a complete suite of mobile and online banking services. Wealth Management offers a wide range of personal and corporate fiduciary services, including the administration of decedent and trust estates. Insurance includes a full-service insurance brokerage service offering across all lines of commercial and personal insurance through major carriers.

Number of Employees: 4,282 |

|

|

| |

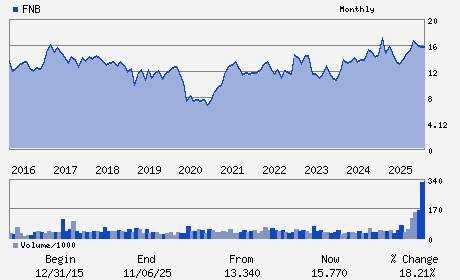

| • Price / Volume Information |

| Yesterday's Closing Price: $16.99 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 7,503,179 shares |

| Shares Outstanding: 357.39 (millions) |

| Market Capitalization: $6,072.04 (millions) |

| Beta: 0.90 |

| 52 Week High: $19.14 |

| 52 Week Low: $10.88 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-3.19% |

-2.34% |

| 12 Week |

0.47% |

0.35% |

| Year To Date |

-0.64% |

-1.13% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Vincent J. Delie, Jr. - Chairman; President and Chief Executive Officer

Vincent J. Calabrese, Jr. - Chief Financial Officer

James L. Dutey - Corporate Controller

Pamela A. Bena - Director

William B. Campbell - Director

|

|

Peer Information

F.N.B. Corporation (TSFG)

F.N.B. Corporation (ABCB)

F.N.B. Corporation (CFNL)

F.N.B. Corporation (CPKF)

F.N.B. Corporation (HIB)

F.N.B. Corporation (FVB)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BANKS-SOUTHEAST

Sector: Finance

CUSIP: 302520101

SIC: 6021

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/15/26

|

|

Share - Related Items

Shares Outstanding: 357.39

Most Recent Split Date: 5.00 (1.05:1)

Beta: 0.90

Market Capitalization: $6,072.04 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.83% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.38 |

Indicated Annual Dividend: $0.48 |

| Current Fiscal Year EPS Consensus Estimate: $1.72 |

Payout Ratio: 0.30 |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: -0.05 |

| Estmated Long-Term EPS Growth Rate: 12.92% |

Last Dividend Paid: 12/01/2025 - $0.12 |

| Next EPS Report Date: 04/15/26 |

|

|

|

| |