| Zacks Company Profile for FS Bancorp, Inc. (FSBW : NSDQ) |

|

|

| |

| • Company Description |

| FS Bancorp, Inc. is a holding company of 1st Security Bank of Washington that delivers banking and financial services to local families, local and regional businesses and industry niches within distinct Puget Sound area communities. It originates home improvement loans, commercial real estate mortgage loans, commercial business loans, and second mortgage/home equity loan products, consumer loans, including home improvement loans. The company also offers various lending products, such as commercial real estate, commercial business, and residential construction lending. FS Bancorp, Inc. is headquartered in Mountlake Terrace, Washington.

Number of Employees: 567 |

|

|

| |

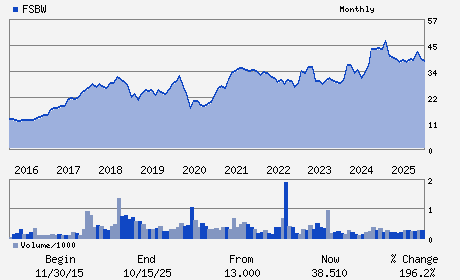

| • Price / Volume Information |

| Yesterday's Closing Price: $39.51 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 9,046 shares |

| Shares Outstanding: 7.52 (millions) |

| Market Capitalization: $297.05 (millions) |

| Beta: 0.71 |

| 52 Week High: $44.22 |

| 52 Week Low: $34.61 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-5.88% |

-5.06% |

| 12 Week |

-2.49% |

-2.61% |

| Year To Date |

-4.03% |

-4.50% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

6920 220TH STREET SW

-

MOUNTLAKE TERRACE,WA 98043

USA |

ph: 425-771-5299

fax: - |

mattm@fsbwa.com |

http://www.fsbwa.com |

|

|

| |

| • General Corporate Information |

Officers

Joseph C. Adams - Chief Executive Officer

Ted A. Leech - Chairman

Matthew D. Mullet - President and Chief Financial Officer; Treasurer a

TerriL. Degner - Director

Joseph P. Zavaglia - Director

|

|

Peer Information

FS Bancorp, Inc. (CACB)

FS Bancorp, Inc. (CPF)

FS Bancorp, Inc. (FMBL)

FS Bancorp, Inc. (GRGN.)

FS Bancorp, Inc. (EVRT)

FS Bancorp, Inc. (EWBC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BANKS-WEST

Sector: Finance

CUSIP: 30263Y104

SIC: 6036

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/28/26

|

|

Share - Related Items

Shares Outstanding: 7.52

Most Recent Split Date: 7.00 (2.00:1)

Beta: 0.71

Market Capitalization: $297.05 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.94% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.01 |

Indicated Annual Dividend: $1.16 |

| Current Fiscal Year EPS Consensus Estimate: $4.43 |

Payout Ratio: 0.26 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.05 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/05/2026 - $0.29 |

| Next EPS Report Date: 04/28/26 |

|

|

|

| |