| Zacks Company Profile for Fortescue Ltd. Sponsored ADR (FSUGY : OTC) |

|

|

| |

| • Company Description |

| Fortescue Ltd engages in the exploration, development, production, processing and sale of iron ore principally in Australia, China and internationally. It primarily explores for copper, gold and lithium deposits and rare earth elements. Fortescue Ltd, formerly known as Fortescue Metals Group Limited, is based in East Perth, Australia.

Number of Employees: 16,000 |

|

|

| |

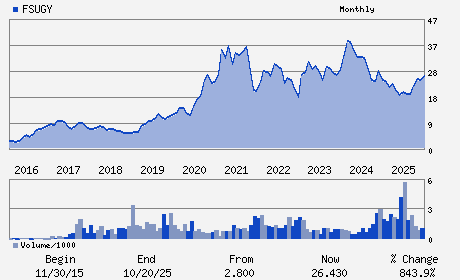

| • Price / Volume Information |

| Yesterday's Closing Price: $29.81 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 34,206 shares |

| Shares Outstanding: 1,539.48 (millions) |

| Market Capitalization: $45,891.97 (millions) |

| Beta: 0.90 |

| 52 Week High: $31.70 |

| 52 Week Low: $16.78 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

3.22% |

4.12% |

| 12 Week |

2.16% |

2.03% |

| Year To Date |

2.40% |

1.91% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

John Andrew Henry Forrest AO - Founder & Executive Chairman

Mark Barnaba AM CitWA - Deputy Chairman; Non-Executive Director

Shelley Robertson - Chief Operating Officer

Apple Paget - Chief Financial Officer

Mona Gill - Company Secretary

|

|

Peer Information

Fortescue Ltd. Sponsored ADR (DMM.)

Fortescue Ltd. Sponsored ADR (HNDNF)

Fortescue Ltd. Sponsored ADR (ANUC)

Fortescue Ltd. Sponsored ADR (CAU)

Fortescue Ltd. Sponsored ADR (ENVG.)

Fortescue Ltd. Sponsored ADR (EMEX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MINING -MISC

Sector: Basic Materials

CUSIP: 34959A206

SIC: 1000

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: -

Next Expected EPS Date: -

|

|

Share - Related Items

Shares Outstanding: 1,539.48

Most Recent Split Date: (:1)

Beta: 0.90

Market Capitalization: $45,891.97 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 5.12% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.56 |

Indicated Annual Dividend: $1.53 |

| Current Fiscal Year EPS Consensus Estimate: $2.34 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: - |

|

|

|

| |