| Zacks Company Profile for FitLife Brands Inc. (FTLF : NSDQ) |

|

|

| |

| • Company Description |

| FitLife Brands, Inc. provides nutritional and fitness enhancement products for health-conscious consumers. The Company's product includes Pump Fuel, ACG3, Core Fuel, Embrace Extreme, Lipo Rush, Cardio Cuts, Dr. Detox, Dr. Cholesterol and Dr. Joints. It market and sells product directly to athletic facilities, gyms and independent retailers. Fitlife Brands, Inc., formerly known as Bond Laboratories Inc., is headquartered in Omaha, Nebraska.

Number of Employees: 39 |

|

|

| |

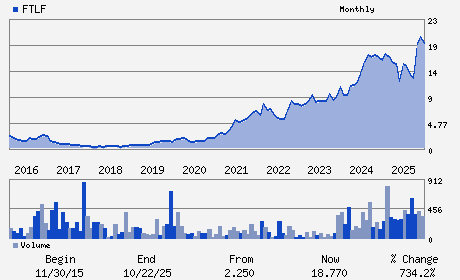

| • Price / Volume Information |

| Yesterday's Closing Price: $15.13 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 15,028 shares |

| Shares Outstanding: 9.39 (millions) |

| Market Capitalization: $142.09 (millions) |

| Beta: 0.41 |

| 52 Week High: $20.98 |

| 52 Week Low: $9.83 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-4.84% |

-4.01% |

| 12 Week |

-12.34% |

-12.45% |

| Year To Date |

-7.01% |

-7.46% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Dayton Judd - Chief Executive Officer and Chairman

Jakob York - Chief Financial Officer

Grant Dawson - Director

Matthew Lingenbrink - Director

Todd Ordal - Director

|

|

Peer Information

FitLife Brands Inc. (BJCT)

FitLife Brands Inc. (CADMQ)

FitLife Brands Inc. (APNO)

FitLife Brands Inc. (UPDC)

FitLife Brands Inc. (IMTIQ)

FitLife Brands Inc. (CYGN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED PRODUCTS

Sector: Medical

CUSIP: 33817P405

SIC: 2833

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/26/26

|

|

Share - Related Items

Shares Outstanding: 9.39

Most Recent Split Date: 2.00 (2.00:1)

Beta: 0.41

Market Capitalization: $142.09 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.49 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.62 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/26/26 |

|

|

|

| |