| Zacks Company Profile for Genpact Limited (G : NYSE) |

|

|

| |

| • Company Description |

| Genpact manages business processes for companies around the world. The company combines process expertise, information technology and analytical capabilities with operational insight and experience in diverse industries to provide a wide range of services using its global delivery platform. Genpact helps companies improve the ways in which they do business by applying Smart Enterprise Processes, Six Sigma and Lean principles. Genpact Cora combines the company's proprietary automation, analytics and AI technologies into a single common platform. The transformation services include digital products, services and solutions, consulting services and analytics offerings. Professional services include finance and accounting services; core industry operations specific services; sourcing, procurement and supply chain services; and IT services. Genpact serves banking and financial services, insurance, consumer goods and retail, life sciences and healthcare, infrastructure, manufacturing industries and capital markets.

Number of Employees: 146,500 |

|

|

| |

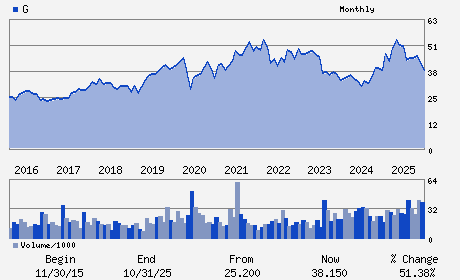

| • Price / Volume Information |

| Yesterday's Closing Price: $39.72 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,133,107 shares |

| Shares Outstanding: 169.86 (millions) |

| Market Capitalization: $6,746.99 (millions) |

| Beta: 0.75 |

| 52 Week High: $54.00 |

| 52 Week Low: $34.79 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-9.93% |

-9.14% |

| 12 Week |

-14.34% |

-14.45% |

| Year To Date |

-15.09% |

-15.50% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Balkrishan Kalra - President and Chief Executive Officer

Michael Weiner - Chief Financial Officer

Ajay Agrawal - Director

Laura Conigliaro - Director

Tamara Franklin - Director

|

|

Peer Information

Genpact Limited (UIS)

Genpact Limited (CTSH)

Genpact Limited (ASGN)

Genpact Limited (GTTNQ)

Genpact Limited (DXC)

Genpact Limited (DOX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: IT Services

Sector: Computer and Technology

CUSIP: G3922B107

SIC: 8742

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 169.86

Most Recent Split Date: (:1)

Beta: 0.75

Market Capitalization: $6,746.99 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.71% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.83 |

Indicated Annual Dividend: $0.68 |

| Current Fiscal Year EPS Consensus Estimate: $3.60 |

Payout Ratio: 0.21 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: -0.01 |

| Estmated Long-Term EPS Growth Rate: 9.44% |

Last Dividend Paid: 12/09/2025 - $0.17 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |