| Zacks Company Profile for Greenbrier Companies, Inc. (The) (GBX : NYSE) |

|

|

| |

| • Company Description |

| Greenbrier Companies Inc., is a leading supplier of transportation equipment and services to the railroad and related industries. The company's manufacturing segment produces double-stack intermodal railcars, conventional railcars and marine vessels, and performs repair and refurbishment activities for both intermodal and conventional railcars. It also engages in complementary leasing and services activities. Greenbrier Europe is an end-to-end freight railcar manufacturing, engineering and repair business with operations in Poland & Romania that serves customers across Europe and in the Middle East. Greenbrier builds freight railcars & rail castings in Brazil through two separate strategic partnerships. It is a leading provider of wheel services, railcar management & regulatory compliance services and leasing services to railroads in North America. Greenbrier offers freight railcar repair, refurbishment and retrofitting services in North America through a joint venture partnership with Watco Companies, LLC.

Number of Employees: 11,000 |

|

|

| |

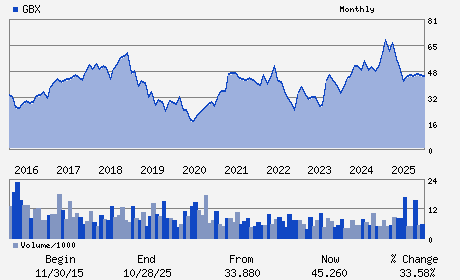

| • Price / Volume Information |

| Yesterday's Closing Price: $56.66 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 276,143 shares |

| Shares Outstanding: 30.89 (millions) |

| Market Capitalization: $1,750.01 (millions) |

| Beta: 1.62 |

| 52 Week High: $59.19 |

| 52 Week Low: $37.77 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

8.11% |

9.71% |

| 12 Week |

24.44% |

24.88% |

| Year To Date |

21.22% |

21.74% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Lorie L. Tekorius - President;Chief Executive Officer and Director

Thomas B. Fargo - Chairman of the Board of Directors

Michael J. Donfris - Senior Vice President;Chief Financial Officer

Stevan B. Bobb - Director

Antonio O. Garza - Director

|

|

Peer Information

Greenbrier Companies, Inc. (The) (AIRL1)

Greenbrier Companies, Inc. (The) (PONY)

Greenbrier Companies, Inc. (The) (ADIN)

Greenbrier Companies, Inc. (The) (GBX)

Greenbrier Companies, Inc. (The) (IPX.)

Greenbrier Companies, Inc. (The) (R)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: TRANS-EQP&LSNG

Sector: Transportation

CUSIP: 393657101

SIC: 3743

|

|

Fiscal Year

Fiscal Year End: August

Last Reported Quarter: 11/01/25

Next Expected EPS Date: 04/06/26

|

|

Share - Related Items

Shares Outstanding: 30.89

Most Recent Split Date: (:1)

Beta: 1.62

Market Capitalization: $1,750.01 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.26% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.98 |

Indicated Annual Dividend: $1.28 |

| Current Fiscal Year EPS Consensus Estimate: $4.40 |

Payout Ratio: 0.22 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: -0.47 |

| Estmated Long-Term EPS Growth Rate: 5.42% |

Last Dividend Paid: 01/27/2026 - $0.32 |

| Next EPS Report Date: 04/06/26 |

|

|

|

| |