| Zacks Company Profile for General Dynamics Corporation (GD : NYSE) |

|

|

| |

| • Company Description |

| General Dynamics is a global aerospace and defense company that specializes in high-end design, engineering and manufacturing to deliver state-of-the-art solutions to customers. It offers a broad portfolio of products and services in business aviation; ship construction and repair; land combat vehicles, weapons systems and munitions; and technology products and services. It comprises 10 business units, which are organized into 4 operating segments: Aerospace, Marine Systems, Combat Systems and Technologies. It refers to the latter 3 collectively as its defense segments. It invests in Aerospace to bring to market an all-new lineup of business jet aircraft, capital investments in Marine Systems to support significant growth in the U.S. Navy ship and submarine construction, development of next-generation platforms & technologies to meet customers? emerging requirements in Combat Systems, and strategic acquisitions to achieve critical mass and build out a complete spectrum of solutions.

Number of Employees: 117,000 |

|

|

| |

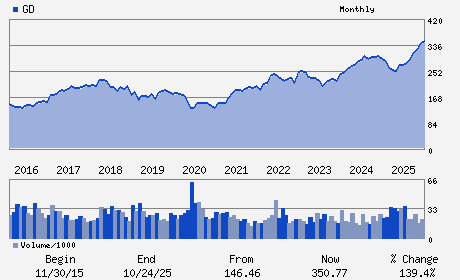

| • Price / Volume Information |

| Yesterday's Closing Price: $357.05 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,212,868 shares |

| Shares Outstanding: 270.39 (millions) |

| Market Capitalization: $96,542.66 (millions) |

| Beta: 0.39 |

| 52 Week High: $369.70 |

| 52 Week Low: $239.20 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

1.70% |

2.59% |

| 12 Week |

5.85% |

5.72% |

| Year To Date |

6.06% |

5.54% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Phebe N. Novakovic - Chairman; Chief Executive Officer and Director

Kimberly A. Kuryea - Senior Vice President and Chief Financial Officer

William A. Moss - Vice President and Controller

Richard D. Clarke - Director

Rudy F. deLeon - Director

|

|

Peer Information

General Dynamics Corporation (BA)

General Dynamics Corporation (HOVR)

General Dynamics Corporation (HWM)

General Dynamics Corporation (LMT)

General Dynamics Corporation (TOD)

General Dynamics Corporation (TXT)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: AEROSP/DEFENSE

Sector: Aerospace

CUSIP: 369550108

SIC: 3730

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/22/26

|

|

Share - Related Items

Shares Outstanding: 270.39

Most Recent Split Date: 3.00 (2.00:1)

Beta: 0.39

Market Capitalization: $96,542.66 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.68% |

| Current Fiscal Quarter EPS Consensus Estimate: $3.72 |

Indicated Annual Dividend: $6.00 |

| Current Fiscal Year EPS Consensus Estimate: $16.27 |

Payout Ratio: 0.39 |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: -0.03 |

| Estmated Long-Term EPS Growth Rate: 10.30% |

Last Dividend Paid: 01/16/2026 - $1.50 |

| Next EPS Report Date: 04/22/26 |

|

|

|

| |