| Zacks Company Profile for GDS Holdings (GDS : NSDQ) |

|

|

| |

| • Company Description |

| GDS Holdings Limited provides information technology service. It offers integrated solutions, consulting, service and training including data center hosting, IT management and operation outsourcing, business continuity management, disaster recovery and cloud computing services. The company operates primarily in Shanghai, Beijing, Shenzhen, Guangzhou and Chengdu. GDS Holdings Limited is headquartered in Shanghai, the People's Republic of China.

Number of Employees: 2,276 |

|

|

| |

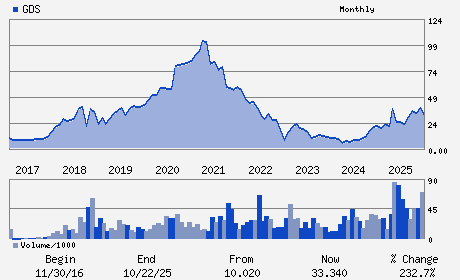

| • Price / Volume Information |

| Yesterday's Closing Price: $41.31 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,035,545 shares |

| Shares Outstanding: (millions) |

| Market Capitalization: $ (millions) |

| Beta: 0.39 |

| 52 Week High: $48.61 |

| 52 Week Low: $16.93 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-7.56% |

-6.75% |

| 12 Week |

17.33% |

17.18% |

| Year To Date |

18.37% |

17.79% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

F4/F5 BUILDING C SUNLAND INTERNATIONAL NO. 999 ZHOUHAI ROAD PUDONG

-

SHANGHAI,F4 200137

CHN |

ph: 86-21-2029-2200

fax: 86-21-2033-0202 |

ir@gds-services.com |

http://www.gds-services.com |

|

|

| |

| • General Corporate Information |

Officers

William Wei Huang - Chairman and Chief Executive Officer

Sio Tat Hiang - Vice-Chairman

Daniel Newman - Chief Financial Officer

Satoshi Okada - Director

Bruno Lopez - Director

|

|

Peer Information

GDS Holdings (EVOL)

GDS Holdings (RAMP)

GDS Holdings (LGTY)

GDS Holdings (ALOT)

GDS Holdings (CXT)

GDS Holdings (TGHI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Technology Services

Sector: Business Services

CUSIP: 36165L108

SIC: 7370

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/18/26

|

|

Share - Related Items

Shares Outstanding:

Most Recent Split Date: (:1)

Beta: 0.39

Market Capitalization: $ (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.17 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.33 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/18/26 |

|

|

|

| |