| Zacks Company Profile for Gilead Sciences, Inc. (GILD : NSDQ) |

|

|

| |

| • Company Description |

| Gilead Sciences is a pioneer in developing drugs for the treatment of human immunodeficiency virus, liver diseases, hematology/oncology diseases and inflammation/respiratory diseases. The company has a strong HIV franchise with key HIV/AIDS therapies like tenofovir alafenamide based products - Genvoya, Odefsey, Descovy, Biktarvy and Truvada. The portfolio also includes hepatitis C virus drugs like Harvoni and Epclusa and HBV drug. The first cell therapy approved for the treatment of adult patients with relapsed or refractory large B-cell lymphoma, has diversified Gilead's portfolio. Tecartus, another CAR T-cell therapy, was granted an accelerated approval in the United States for the treatment of relapsed or refractory mantle cell lymphoma. The company is also working on diversifying and growing its business beyond antivirals into other therapeutic areas. Gilead is also making inroads in the oncology space with strategic collaborations and acquisitions.

Number of Employees: 17,000 |

|

|

| |

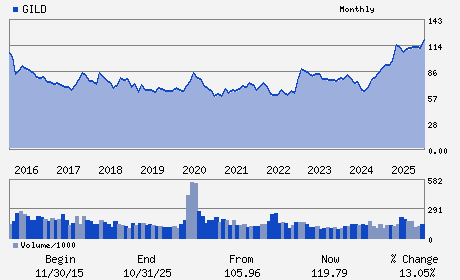

| • Price / Volume Information |

| Yesterday's Closing Price: $150.03 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 7,532,598 shares |

| Shares Outstanding: 1,241.42 (millions) |

| Market Capitalization: $186,250.33 (millions) |

| Beta: 0.37 |

| 52 Week High: $157.29 |

| 52 Week Low: $93.37 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

5.00% |

6.44% |

| 12 Week |

23.80% |

23.17% |

| Year To Date |

22.23% |

21.59% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Daniel P. O'Day - Chairman and Chief Executive Officer

Andrew D. Dickinson - Chief Financial Officer

Erin E. Burkhart - Senior Vice President; Controllership and Chief Ac

Jacqueline K. Barton - Director

Jeffrey A. Bluestone - Director

|

|

Peer Information

Gilead Sciences, Inc. (CORR.)

Gilead Sciences, Inc. (RSPI)

Gilead Sciences, Inc. (CGXP)

Gilead Sciences, Inc. (BGEN)

Gilead Sciences, Inc. (GTBP)

Gilead Sciences, Inc. (RGRX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED-BIOMED/GENE

Sector: Medical

CUSIP: 375558103

SIC: 2836

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/23/26

|

|

Share - Related Items

Shares Outstanding: 1,241.42

Most Recent Split Date: 1.00 (2.00:1)

Beta: 0.37

Market Capitalization: $186,250.33 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.11% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.86 |

Indicated Annual Dividend: $3.16 |

| Current Fiscal Year EPS Consensus Estimate: $8.66 |

Payout Ratio: 0.39 |

| Number of Estimates in the Fiscal Year Consensus: 13.00 |

Change In Payout Ratio: -0.08 |

| Estmated Long-Term EPS Growth Rate: 8.81% |

Last Dividend Paid: 12/15/2025 - $0.79 |

| Next EPS Report Date: 04/23/26 |

|

|

|

| |