| Zacks Company Profile for General Mills, Inc. (GIS : NYSE) |

|

|

| |

| • Company Description |

| General Mills Inc. is a global manufacturer and marketer of branded consumer foods sold through retail stores. The company also serves the foodservice and commercial baking industries. Its principal product categories include ready-to-eat cereals, convenient meals, snacks (including grain, fruit and savory snacks, nutrition bars, and frozen hot snacks), yogurt, super-premium ice creams as well as baking mixes and ingredients.

Number of Employees: 33,000 |

|

|

| |

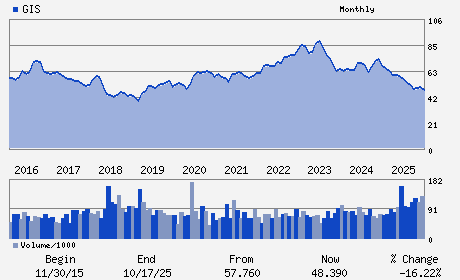

| • Price / Volume Information |

| Yesterday's Closing Price: $45.23 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 7,661,209 shares |

| Shares Outstanding: 533.58 (millions) |

| Market Capitalization: $24,133.92 (millions) |

| Beta: -0.05 |

| 52 Week High: $67.35 |

| 52 Week Low: $42.79 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-2.23% |

-1.37% |

| 12 Week |

-1.52% |

-1.65% |

| Year To Date |

-2.73% |

-3.20% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Jeffrey L. Harmening - Chief Executive Officer; Chairman and Director

Kofi A. Bruce - Chief Financial Officer

Mark A. Pallot - Vice President and Chief Accounting Officer

Benno O. Dorer - Director

C. Kim Goodwin - Director

|

|

Peer Information

General Mills, Inc. (CDSCY)

General Mills, Inc. (HDNHY)

General Mills, Inc. (CPB)

General Mills, Inc. (AMNF)

General Mills, Inc. (GMFIY)

General Mills, Inc. (BRID)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FOOD-MISC/DIVERSIFIED

Sector: Consumer Staples

CUSIP: 370334104

SIC: 2040

|

|

Fiscal Year

Fiscal Year End: May

Last Reported Quarter: 11/01/25

Next Expected EPS Date: 03/18/26

|

|

Share - Related Items

Shares Outstanding: 533.58

Most Recent Split Date: 6.00 (2.00:1)

Beta: -0.05

Market Capitalization: $24,133.92 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 5.39% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.79 |

Indicated Annual Dividend: $2.44 |

| Current Fiscal Year EPS Consensus Estimate: $3.53 |

Payout Ratio: 0.66 |

| Number of Estimates in the Fiscal Year Consensus: 9.00 |

Change In Payout Ratio: 0.12 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 01/09/2026 - $0.61 |

| Next EPS Report Date: 03/18/26 |

|

|

|

| |