| Zacks Company Profile for SPDR Gold Shares (GLD : NYSE) |

|

|

| |

| • Company Description |

| Street Tracks Gold Shares offer investors a new, innovative, relatively cost efficient and secure way to access the gold market. Gold Shares are intended to offer investors a means of participating in the gold bullion market without the necessity of taking physical delivery of gold, & to buy and sell that interest through the trading of a security on a regulated stock exchange. The introduction of Gold Shares is intended to lower many of the barriers, such as access, custody, and transaction costs, that have prevented some investors from investing in gold. Gold Shares represent fractional, undivided beneficial ownership interests in the Trust, the sole assets of which are gold bullion, from time to time, cash. Gold Shares are intended to lower a large number of the barriers preventing investors from using gold as an asset allocation and trading tool. These barriers have included the logistics of buying, storing & insuring gold.

Number of Employees: |

|

|

| |

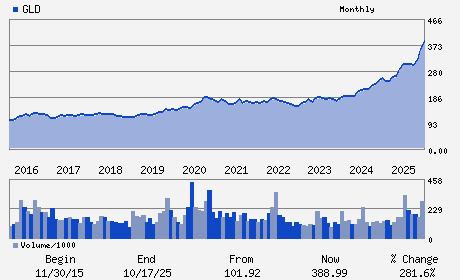

| • Price / Volume Information |

| Yesterday's Closing Price: $483.75 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 15,351,650 shares |

| Shares Outstanding: 384.00 (millions) |

| Market Capitalization: $185,760.00 (millions) |

| Beta: 0.12 |

| 52 Week High: $509.70 |

| 52 Week Low: $265.07 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

8.72% |

9.67% |

| 12 Week |

25.18% |

25.03% |

| Year To Date |

22.06% |

21.47% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

685 THIRD AVENUE SUITE 2702

-

NEW YORK,NY 10017

USA |

ph: 212-317-3800

fax: - |

None |

http://www.spdrgoldshares.com |

|

|

| |

| • General Corporate Information |

Officers

Joseph R. Cavatoni - Principal Executive Officer

Amanda Krichman - Principal Financial and Accounting Officer

William J. Shea - Director

Molly Duffy - Director

David Tait - Director

|

|

Peer Information

- (-)

- (-)

- (-)

- (-)

- (-)

- (-)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FIN-INVEST FUND

Sector: Finance

CUSIP: 78463V107

SIC: 6221

|

|

Fiscal Year

Fiscal Year End: September

Last Reported Quarter: -

Next Expected EPS Date: -

|

|

Share - Related Items

Shares Outstanding: 384.00

Most Recent Split Date: (:1)

Beta: 0.12

Market Capitalization: $185,760.00 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: - |

|

|

|

| |