| Zacks Company Profile for GameStop Corp. (GME : NYSE) |

|

|

| |

| • Company Description |

| GameStop Corp. offers the best selection of new and pre-owned video gaming consoles, accessories and video game titles, in both physical and digital formats. The company sells various types of digital products, including downloadable content, network points cards, prepaid digital, prepaid subscription cards and digitally downloadable software as well as collectible products. The company also publishes Game Informer, the print and digital video game publication. The company's products are categorized as follows: Hardware and Accessories - GameStop offers new and pre-owned video game platforms from the major console and PC manufacturers. Accessories consist primarily of controllers, gaming headsets, virtual reality products and memory cards. Software: The company provides new and pre-owned video game software for current and certain prior generation consoles. Collectibles: The category consists of licensed merchandise, primarily related to the video game, television and movie industries and pop-culture themes.

Number of Employees: 6,000 |

|

|

| |

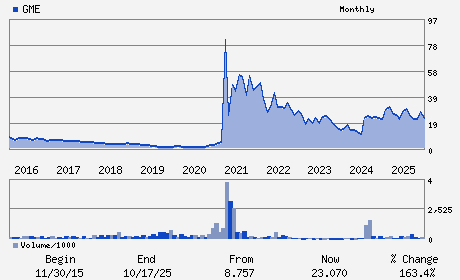

| • Price / Volume Information |

| Yesterday's Closing Price: $24.20 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 6,080,361 shares |

| Shares Outstanding: 448.01 (millions) |

| Market Capitalization: $10,841.83 (millions) |

| Beta: 2.12 |

| 52 Week High: $32.55 |

| 52 Week Low: $18.85 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-6.38% |

-5.09% |

| 12 Week |

3.64% |

3.11% |

| Year To Date |

20.52% |

19.89% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

625 WESTPORT PARKWAY

-

GRAPEVINE,TX 76051

USA |

ph: 817-424-2000

fax: 817-424-2002 |

ir@gamestop.com |

http://www.gamestop.com |

|

|

| |

| • General Corporate Information |

Officers

Ryan Cohen - Chief Executive Officer; President and Chairman

Daniel Moore - Chief Financial and Accounting Officer

Alan Attal - Director

Larry Cheng - Director

Jim Grube - Director

|

|

Peer Information

GameStop Corp. (CHLD.)

GameStop Corp. (FGRD)

GameStop Corp. (CGMI.)

GameStop Corp. (AGAM.)

GameStop Corp. (ASCA.)

GameStop Corp. (BYD)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: GAMING

Sector: Consumer Discretionary

CUSIP: 36467W109

SIC: 5734

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/24/26

|

|

Share - Related Items

Shares Outstanding: 448.01

Most Recent Split Date: 7.00 (4.00:1)

Beta: 2.12

Market Capitalization: $10,841.83 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/24/26 |

|

|

|

| |