| Zacks Company Profile for Genworth Financial, Inc. (GNW : NYSE) |

|

|

| |

| • Company Description |

| Genworth Financial, through its principal insurance subsidiaries, offers mortgage and long-term care insurance products. Genworth Financial's legacy U.S. life insurance subsidiaries offer long-term care insurance and also manage in-force blocks of life insurance and annuity products that are no longer sold. Genworth Financial also has a start-up business whereby it offers fee-based services, advice, consulting and other aging-care products and services through CareScout.

Number of Employees: 2,960 |

|

|

| |

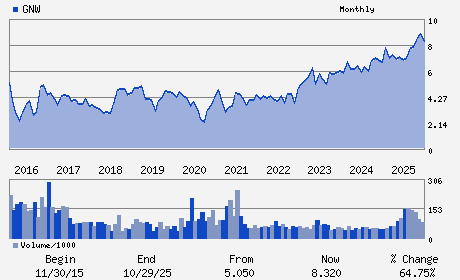

| • Price / Volume Information |

| Yesterday's Closing Price: $8.44 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,432,193 shares |

| Shares Outstanding: 399.38 (millions) |

| Market Capitalization: $3,370.77 (millions) |

| Beta: 1.00 |

| 52 Week High: $9.28 |

| 52 Week Low: $5.99 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

1.20% |

2.08% |

| 12 Week |

-2.54% |

-2.66% |

| Year To Date |

-6.53% |

-6.99% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Thomas J. McInerney - Chief Executive Officer;President

Melina E. Higgins - Non-Executive Chair of the Board

Jerome T. Upton - Chief Financial Officer;Executive Vice President

Darren W. Woodell - Vice President and Controller

G. Kent Conrad - Director

|

|

Peer Information

Genworth Financial, Inc. (AGC.)

Genworth Financial, Inc. (T.GWO)

Genworth Financial, Inc. (AMH.2)

Genworth Financial, Inc. (CSLI.)

Genworth Financial, Inc. (CIA)

Genworth Financial, Inc. (DFG)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INS-LIFE

Sector: Finance

CUSIP: 37247D106

SIC: 6311

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 399.38

Most Recent Split Date: (:1)

Beta: 1.00

Market Capitalization: $3,370.77 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |