| Zacks Company Profile for GoHealth, Inc. (GOCO : NSDQ) |

|

|

| |

| • Company Description |

| GoHealth, Inc. provides health insurance marketplace. It offer health insurance policies, including Medicare advantage, Medicare supplement, Medicare prescription drug plans, Medicare special needs plans; individual and family, dental, vision and other related plans, through its platform. GoHealth, Inc. is based in Chicago, Illinois.

Number of Employees: 2,261 |

|

|

| |

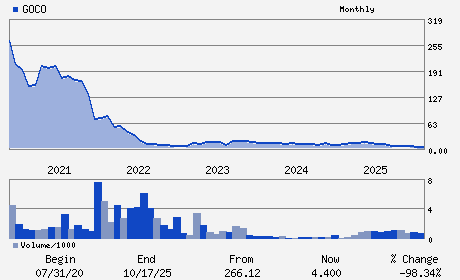

| • Price / Volume Information |

| Yesterday's Closing Price: $1.37 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 37,806 shares |

| Shares Outstanding: 28.71 (millions) |

| Market Capitalization: $39.34 (millions) |

| Beta: 1.70 |

| 52 Week High: $17.01 |

| 52 Week Low: $1.31 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-36.57% |

-36.02% |

| 12 Week |

-54.78% |

-54.84% |

| Year To Date |

-36.28% |

-36.59% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

222 W MERCHANDISE MART PLAZA SUITE 1750

-

CHICAGO,IL 60654

USA |

ph: 312-386-8200

fax: - |

ir@gohealth.com |

http://www.gohealth.com |

|

|

| |

| • General Corporate Information |

Officers

Vijay Kotte - Chief Executive Officer

Clinton Jones - Co-Chairman

Michael Hargis - Chief Operating Officer

Brendan Shanahan - Chief Financial Officer

Jeremy Gelber - Director

|

|

Peer Information

GoHealth, Inc. (AGC.)

GoHealth, Inc. (T.GWO)

GoHealth, Inc. (AMH.2)

GoHealth, Inc. (CSLI.)

GoHealth, Inc. (CIA)

GoHealth, Inc. (DFG)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INS-LIFE

Sector: Finance

CUSIP: 38046W204

SIC: 6411

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/26/26

|

|

Share - Related Items

Shares Outstanding: 28.71

Most Recent Split Date: 11.00 (0.07:1)

Beta: 1.70

Market Capitalization: $39.34 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-2.93 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-9.27 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 20.00% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 02/26/26 |

|

|

|

| |