| Zacks Company Profile for Green Plains, Inc. (GPRE : NSDQ) |

|

|

| |

| • Company Description |

| Green Plains Inc. is vertically integrated producer, marketer and distributer of ethanol. The company operates through four segments: Ethanol Production, Corn Oil Production, Agribusiness, and Marketing and Distribution. It produces ethanol and co-products, such as wet, modified wet or dried distillers grains, as well as extracts non-edible corn oil. The company is also involved in buying and selling bulk grain primarily corn and soybeans. Green Plains Inc., formerly known as Green Plains Renewable Energy, Inc., is headquartered in Omaha, Nebraska.

Number of Employees: 642 |

|

|

| |

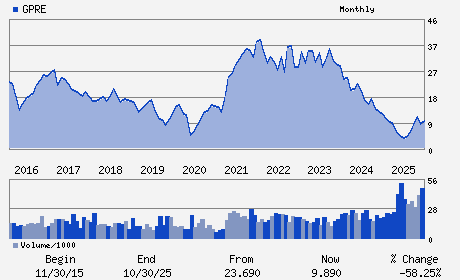

| • Price / Volume Information |

| Yesterday's Closing Price: $13.73 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,819,174 shares |

| Shares Outstanding: 69.84 (millions) |

| Market Capitalization: $958.89 (millions) |

| Beta: 1.46 |

| 52 Week High: $15.64 |

| 52 Week Low: $3.14 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

19.81% |

20.86% |

| 12 Week |

40.97% |

40.79% |

| Year To Date |

40.10% |

39.42% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Chris G. Osowski - Chief Executive Officer and President

Jim Anderson - Chairman of the Board

Ann Reis - Chief Financial Officer

Farha Aslam - Director

Steve Furcich - Director

|

|

Peer Information

Green Plains, Inc. (CSBHY)

Green Plains, Inc. (ARWM)

Green Plains, Inc. (FUL)

Green Plains, Inc. (IAX)

Green Plains, Inc. (AVD)

Green Plains, Inc. (ASH)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CHEM-SPECIALTY

Sector: Basic Materials

CUSIP: 393222104

SIC: 2860

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 69.84

Most Recent Split Date: (:1)

Beta: 1.46

Market Capitalization: $958.89 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.05 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.46 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 47.58% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |