| Zacks Company Profile for Hyatt Hotels Corporation (H : NYSE) |

|

|

| |

| • Company Description |

| Hyatt Hotels Corporation is a global hospitality company engaged in the development, ownership, operation, management, franchising and licensing of properties, including hotels, resorts and residential and vacation ownership properties around the world. Hyatt manages its business in 4 reportable segments: The Owned and Leased Hotels segment consists of the company's owned and leased hotel properties located mostly in the US and international locations. The Americas Management and Franchising segment includes management and franchising of the properties located in the US, Latin America, Canada and the Caribbean. The ASPAC Management and Franchising segment comprises the company's management and franchising of properties located in Southeast Asia, as well as China, Australia, South Korea, Japan and Micronesia. The EAME/SW Asia Management and Franchising segment encompasses the company's management and franchising of properties located primarily in Europe, Africa, the Middle East, India, Central Asia and Nepal.

Number of Employees: 242,000 |

|

|

| |

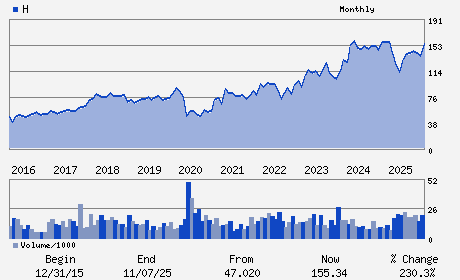

| • Price / Volume Information |

| Yesterday's Closing Price: $161.50 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,062,628 shares |

| Shares Outstanding: 94.47 (millions) |

| Market Capitalization: $15,256.54 (millions) |

| Beta: 1.22 |

| 52 Week High: $180.53 |

| 52 Week Low: $102.43 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

3.28% |

4.18% |

| 12 Week |

3.53% |

3.40% |

| Year To Date |

0.74% |

0.25% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Mark S. Hoplamazian - President and Chief Executive Officer

Thomas J. Pritzker - Executive Chairman

Joan Bottarini - Executive Vice President and Chief Financial Offic

Kinsey Wolf - Senior Vice President

Paul D. Ballew - Director

|

|

Peer Information

Hyatt Hotels Corporation (HOT.)

Hyatt Hotels Corporation (CHH)

Hyatt Hotels Corporation (ESA.)

Hyatt Hotels Corporation (GPSRY)

Hyatt Hotels Corporation (FS)

Hyatt Hotels Corporation (CLMDY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: HOTELS & MOTELS

Sector: Consumer Discretionary

CUSIP: 448579102

SIC: 7011

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 94.47

Most Recent Split Date: (:1)

Beta: 1.22

Market Capitalization: $15,256.54 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.37% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.69 |

Indicated Annual Dividend: $0.60 |

| Current Fiscal Year EPS Consensus Estimate: $3.23 |

Payout Ratio: 0.28 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: 0.09 |

| Estmated Long-Term EPS Growth Rate: 26.59% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |