| Zacks Company Profile for Haemonetics Corporation (HAE : NYSE) |

|

|

| |

| • Company Description |

| Haemonetics Corp. provides blood management solutions to customers encompassing blood and plasma collectors, hospitals and health care providers globally. Its portfolio of integrated devices, information management, and consulting services offers blood management solutions for each facet of the blood supply chain, helping better clinical outcomes. It acquired Pall Corporation's blood collection, filtration and processing product lines. It entered into a long-term supply agreement with Pall. The company acquired Hemerus Medical. It operates under 3 segments: Plasma, Blood Center, and Hospital. Plasma includes plasma collection devices and disposables, plasma donor management software, anticoagulant and saline sold to plasma customers. Blood Center includes blood collection and processing devices and disposables for red cells, platelets and whole blood as well as related donor management software. Hospital includes three product lines, namely, Hemostasis Management, Cell Salvage and Transfusion Management.

Number of Employees: 3,023 |

|

|

| |

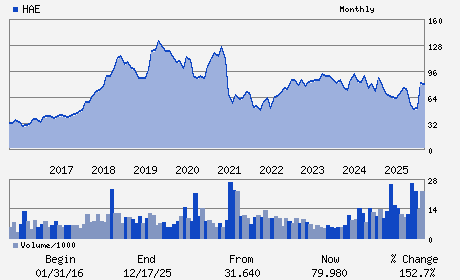

| • Price / Volume Information |

| Yesterday's Closing Price: $63.32 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 985,202 shares |

| Shares Outstanding: 46.47 (millions) |

| Market Capitalization: $2,942.57 (millions) |

| Beta: 0.28 |

| 52 Week High: $87.32 |

| 52 Week Low: $47.32 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-5.01% |

-4.18% |

| 12 Week |

-24.57% |

-24.66% |

| Year To Date |

-21.00% |

-21.38% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Christopher A. Simon - Chief Executive Officer;President and Director

James C. D'Arecca - Executive Vice President; Chief Financial Officer

Maryanne E. Farris - Vice President; Chief Accounting Officer

Robert E. Abernathy - Director

Diane M. Bryant - Director

|

|

Peer Information

Haemonetics Corporation (BJCT)

Haemonetics Corporation (CADMQ)

Haemonetics Corporation (APNO)

Haemonetics Corporation (UPDC)

Haemonetics Corporation (IMTIQ)

Haemonetics Corporation (CYGN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED PRODUCTS

Sector: Medical

CUSIP: 405024100

SIC: 3841

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 46.47

Most Recent Split Date: 12.00 (2.00:1)

Beta: 0.28

Market Capitalization: $2,942.57 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.28 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $4.95 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 9.67% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |