| Zacks Company Profile for Halozyme Therapeutics, Inc. (HALO : NSDQ) |

|

|

| |

| • Company Description |

| Halozyme Therapeutics Inc. is a biopharmaceutical company, focused on the development and commercialization of novel treatments for oncology indications by targeting tumor microenvironment. The company's ENHANZE drug delivery technology helps in developing subcutaneous formulation of drugs. The company also licenses its novel drug delivery technology, ENHANZE. Several companies including Roche, Takeda, J&J, AbbVie, Lilly, Bristol-Myers and others are using this technology for developing subcutaneous formulation of their currently marketed drugs. It also recognizes revenues from sale of drug products to its collaboration partners for development of drugs using its ENHANZE platform. The company also has one approved product in its portfolio, Hylenex recombinant as an adjuvant to facilitate subcutaneous fluid administration. Although Halozyme has one marketed product, it derives the majority of its revenues from royalties on sales of partnered drugs.

Number of Employees: 423 |

|

|

| |

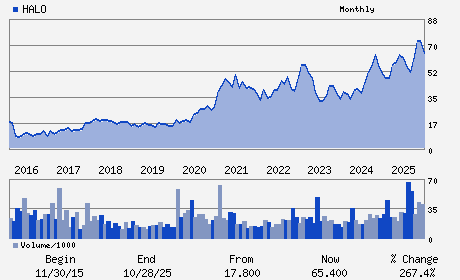

| • Price / Volume Information |

| Yesterday's Closing Price: $69.53 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,134,786 shares |

| Shares Outstanding: 118.02 (millions) |

| Market Capitalization: $8,205.72 (millions) |

| Beta: 0.98 |

| 52 Week High: $82.22 |

| 52 Week Low: $47.50 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-3.04% |

-2.19% |

| 12 Week |

9.79% |

9.65% |

| Year To Date |

3.31% |

2.81% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

12390 EL CAMINO REAL

-

SAN DIEGO,CA 92130

USA |

ph: 858-794-8889

fax: 858-704-8311 |

ir@halozyme.com |

http://www.halozyme.com |

|

|

| |

| • General Corporate Information |

Officers

Helen I. Torley - PresidentandChiefExecutiveOfficer; Director

Jeffrey W. Henderson - Chair of the Board of Directors

Nicole LaBrosse - Senior VicePresident andChiefFinancialOfficer

Bernadette Connaughton - Director

Barbara Duncan - Director

|

|

Peer Information

Halozyme Therapeutics, Inc. (CORR.)

Halozyme Therapeutics, Inc. (RSPI)

Halozyme Therapeutics, Inc. (CGXP)

Halozyme Therapeutics, Inc. (BGEN)

Halozyme Therapeutics, Inc. (GTBP)

Halozyme Therapeutics, Inc. (RGRX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED-BIOMED/GENE

Sector: Medical

CUSIP: 40637H109

SIC: 2836

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 118.02

Most Recent Split Date: (:1)

Beta: 0.98

Market Capitalization: $8,205.72 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.55 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $7.72 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 32.00% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |