| Zacks Company Profile for Healthcare Services Group, Inc. (HCSG : NSDQ) |

|

|

| |

| • Company Description |

| Healthcare Services Group, Inc. provides housekeeping, laundry, linen, facility maintenance and food services to the health care industry, including nursing homes, retirement complexes, rehabilitation centers and hospitals. Healthcare Services Group has the experience and expertise to meet these needs, making the preferred choice for hospital and senior living clients nationwide. Healthcare Services Group has delivered exceptional housekeeping/laundry and dining/nutrition services to an ever-changing healthcare industry. Healthcare Services provide professional management of ancillary services to a diverse mix of satisfied clients. Flexible and responsive, our people are trained to help you achieve success by delivering innovative solutions, exceptional performance and measurable results.

Number of Employees: 36,000 |

|

|

| |

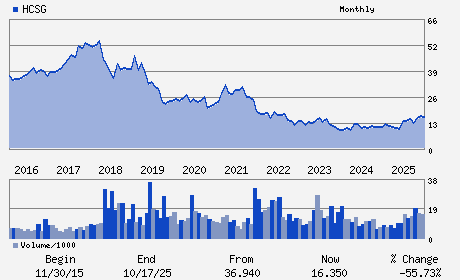

| • Price / Volume Information |

| Yesterday's Closing Price: $21.77 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 903,218 shares |

| Shares Outstanding: 70.27 (millions) |

| Market Capitalization: $1,529.72 (millions) |

| Beta: 0.73 |

| 52 Week High: $22.98 |

| 52 Week Low: $9.13 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

15.68% |

16.69% |

| 12 Week |

15.31% |

15.16% |

| Year To Date |

13.86% |

13.31% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Theodore Wahl - Chief Executive Officer;President and Director

Jude Visconto - Chairman of the Board

Vikas Singh - Executive Vice President and Chief Financial Offic

Andrew M. Brophy - Senior Vice President and Chief Accounting Officer

Diane S. Casey - Director

|

|

Peer Information

Healthcare Services Group, Inc. (AGIS)

Healthcare Services Group, Inc. (SKCO)

Healthcare Services Group, Inc. (AWWC)

Healthcare Services Group, Inc. (AQUX)

Healthcare Services Group, Inc. (AVSV)

Healthcare Services Group, Inc. (AMGC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BUSINESS SVCS

Sector: Business Services

CUSIP: 421906108

SIC: 8050

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/22/26

|

|

Share - Related Items

Shares Outstanding: 70.27

Most Recent Split Date: 11.00 (1.50:1)

Beta: 0.73

Market Capitalization: $1,529.72 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.22 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.94 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: -0.63 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/22/26 |

|

|

|

| |