| Zacks Company Profile for Henkel AG & Co. (HENKY : OTC) |

|

|

| |

| • Company Description |

| HENKEL KGAA ADR's principal activities are divided into four product divisions: Henkel technologies-industrial adhesives, contact adhesives and sealant; Cosmetics/toiletries-hair cosmetics, toiletries, oral and skin care, hair salon products; Detergents/household cleaners-heavy duty and specialty detergents, fabric softeners, household cleansers, kitchen care products, shoe care products, plant care products; Adhesives-adhesives, contact adhesives and sealant for consumer and craftsman.

Number of Employees: 47,150 |

|

|

| |

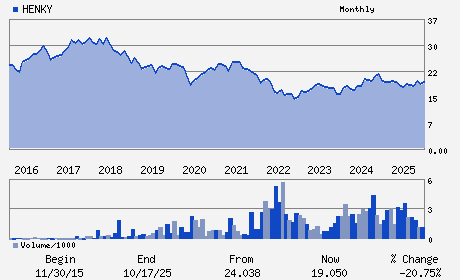

| • Price / Volume Information |

| Yesterday's Closing Price: $19.61 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 84,185 shares |

| Shares Outstanding: 1,751.83 (millions) |

| Market Capitalization: $34,353.48 (millions) |

| Beta: 0.56 |

| 52 Week High: $21.30 |

| 52 Week Low: $16.54 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

1.87% |

-0.62% |

| 12 Week |

2.51% |

-0.53% |

| Year To Date |

2.51% |

1.05% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Carsten Knobel - Chief Executive Officer and Chairman

Marco Swoboda - Executive Vice President and Chief Financial Offic

Jan-Dirk Auris - Executive Vice President

Andrea Pichottka - Director

Stefan Sudhoff - Director

|

|

Peer Information

Henkel AG & Co. (EPC)

Henkel AG & Co. (HPPS)

Henkel AG & Co. (ADRNY)

Henkel AG & Co. (YHGJ)

Henkel AG & Co. (GPSYY)

Henkel AG & Co. (HENKY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CONS PD- MISC STPL

Sector: Consumer Staples

CUSIP: 42550U109

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: -

Next Expected EPS Date: 03/11/26

|

|

Share - Related Items

Shares Outstanding: 1,751.83

Most Recent Split Date: 1.00 (4.00:1)

Beta: 0.56

Market Capitalization: $34,353.48 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.99% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.39 |

| Current Fiscal Year EPS Consensus Estimate: $1.58 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/11/26 |

|

|

|

| |