| Zacks Company Profile for H.I.S. Co., Ltd. (HISJF : OTC) |

|

|

| |

| • Company Description |

| H.I.S. Co., Ltd. provides travel agency services. The company offers business trips, group tours and package tours; Skywalker cards and gift cards; overseas travel insurance products. It operates primarily in Australia, Bali Island, Guam, Thailand and South Korea. H.I.S. Co., Ltd. is based in Tokyo, Japan.

Number of Employees: 12,710 |

|

|

| |

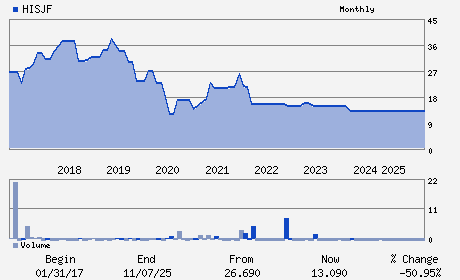

| • Price / Volume Information |

| Yesterday's Closing Price: $13.09 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 0 shares |

| Shares Outstanding: 74.72 (millions) |

| Market Capitalization: $978.14 (millions) |

| Beta: -0.29 |

| 52 Week High: $ |

| 52 Week Low: $ |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

0.00% |

0.87% |

| 12 Week |

0.00% |

-0.12% |

| Year To Date |

0.00% |

-0.49% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

Kamiyacho Trust Tower 5th Floor 4-1-1 Toranomon

-

Tokyo,M0 105-6905

JPN |

ph: 81-50-1746-4188

fax: - |

None |

http://www.his.co.jp |

|

|

| |

| • General Corporate Information |

Officers

Motoshi Yada - President; Chief Executive Officer and Director

Nakamori Tatsuya - Director

Oda Masayuki - Director

Yamanobe Atsushi - Director

Gomi Mutsumi - Director

|

|

Peer Information

H.I.S. Co., Ltd. (KJFI)

H.I.S. Co., Ltd. (MBEW)

H.I.S. Co., Ltd. (DVD)

H.I.S. Co., Ltd. (GCCXQ)

H.I.S. Co., Ltd. (AMIEQ)

H.I.S. Co., Ltd. (FAIR)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: LEISURE&REC SVS

Sector: Consumer Discretionary

CUSIP: J20087102

SIC: 4724

|

|

Fiscal Year

Fiscal Year End: October

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/30/26

|

|

Share - Related Items

Shares Outstanding: 74.72

Most Recent Split Date: (:1)

Beta: -0.29

Market Capitalization: $978.14 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/30/26 |

|

|

|

| |