| Zacks Company Profile for Highwoods Properties, Inc. (HIW : NYSE) |

|

|

| |

| • Company Description |

| Highwoods Properties, Inc. is an office real estate investment trust (REIT) that owns, develops, acquires, leases and manages office properties. Its core portfolio consists of properties in the best business districts (BBDs) within its footprint of Atlanta, Charlotte, Nashville, Orlando, Pittsburgh, Raleigh, Richmond and Tampa. The company's long-term strategic plan entails acquisition of high-quality, trophy office buildings in the BBDs of markets that enjoy favorable economic and demographic trends.

Number of Employees: 315 |

|

|

| |

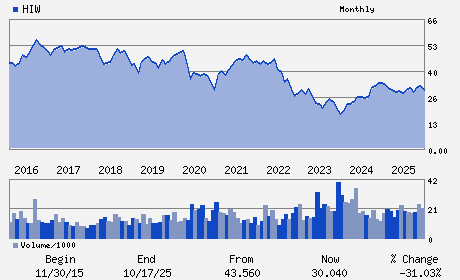

| • Price / Volume Information |

| Yesterday's Closing Price: $22.62 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,595,165 shares |

| Shares Outstanding: 109.93 (millions) |

| Market Capitalization: $2,486.64 (millions) |

| Beta: 1.07 |

| 52 Week High: $32.76 |

| 52 Week Low: $21.56 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-10.49% |

-9.25% |

| 12 Week |

-11.78% |

-12.23% |

| Year To Date |

-12.39% |

-12.85% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Theodore J. Klinck - Chief Executive Officer; President and Director

Carlos E. Evans - Chairman of the Board of Directors

Brendan C. Maiorana - Executive Vice President and Chief Financial Offic

Daniel L. Clemmens - Senior Vice President and Chief Accounting Officer

Charles A. Anderson - Director

|

|

Peer Information

Highwoods Properties, Inc. (ARE)

Highwoods Properties, Inc. (CUZ)

Highwoods Properties, Inc. (FUR)

Highwoods Properties, Inc. (NNN)

Highwoods Properties, Inc. (FCH)

Highwoods Properties, Inc. (CTO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: REIT-EQTY TRUST -OTHER

Sector: Finance

CUSIP: 431284108

SIC: 6798

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 109.93

Most Recent Split Date: (:1)

Beta: 1.07

Market Capitalization: $2,486.64 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 8.84% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.85 |

Indicated Annual Dividend: $2.00 |

| Current Fiscal Year EPS Consensus Estimate: $3.54 |

Payout Ratio: 0.57 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: 0.04 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/17/2026 - $0.50 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |