| Zacks Company Profile for Helios Technologies, Inc (HLIO : NYSE) |

|

|

| |

| • Company Description |

| Helios Technologies Inc. is an industrial technology company. It develops and manufactures hydraulic and electronic control solutions. The company's operating subsidiaries includes Sun Hydraulics, Enovation Controls and Faster Group. Its operating business segment consists of Hydraulics and Electronics. Hydraulics segment includes material handling, construction equipment, agriculture, specialized vehicles and energy. Electronics segment provides electronic control solutions. Helios Technologies Inc., formerly known as Sun Hydraulics Corporation, is based in Sarasota, United States.

Number of Employees: 2,500 |

|

|

| |

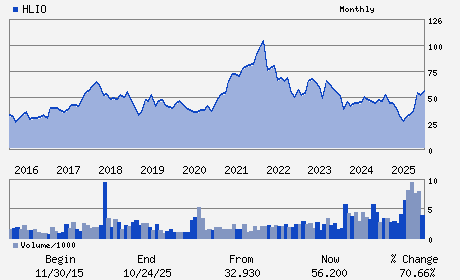

| • Price / Volume Information |

| Yesterday's Closing Price: $71.32 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 295,064 shares |

| Shares Outstanding: 33.13 (millions) |

| Market Capitalization: $2,362.72 (millions) |

| Beta: 1.26 |

| 52 Week High: $76.16 |

| 52 Week Low: $24.76 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

10.10% |

11.06% |

| 12 Week |

31.61% |

31.45% |

| Year To Date |

33.33% |

32.69% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Sean Bagan - President; Chief Executive Officer and Chief Finan

Philippe Lemaitre - Chairman of the Board of Directors

Laura Dempsey Brown - Director

Douglas M. Britt - Director

Douglas M. Britt - Director

|

|

Peer Information

Helios Technologies, Inc (B.)

Helios Technologies, Inc (DXPE)

Helios Technologies, Inc (AIT)

Helios Technologies, Inc (GDI.)

Helios Technologies, Inc (CTITQ)

Helios Technologies, Inc (EBCOY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MACH-GENL INDL

Sector: Industrial Products

CUSIP: 42328H109

SIC: 3490

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/02/26

|

|

Share - Related Items

Shares Outstanding: 33.13

Most Recent Split Date: 7.00 (1.50:1)

Beta: 1.26

Market Capitalization: $2,362.72 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.50% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.62 |

Indicated Annual Dividend: $0.36 |

| Current Fiscal Year EPS Consensus Estimate: $2.72 |

Payout Ratio: 0.17 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: 0.04 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 01/07/2026 - $0.09 |

| Next EPS Report Date: 03/02/26 |

|

|

|

| |