| Zacks Company Profile for Honda Motor Co., Ltd. (HMC : NYSE) |

|

|

| |

| • Company Description |

| Honda Motor Co., Ltd. is a leading manufacturer of automobiles and motorcycles in the world. Honda is recognized internationally for its wide variety of products, ranging from small general-purpose engines to specialty sports cars. Honda operates through 4 business segments: The?Automobiles?segment produces passenger cars, minivans, multi-wagons, sport utility vehicles and mini cars. The?Motorcycles?segment produces motorcycles consisting of sports, business and commuter models, all-terrain vehicles, personal watercraft and multi-utility vehicles. The?Financial Services?offers various financial services that include retail lending and leasing to customers, as well as other financial services, such as wholesale financing to dealers. The?Life Creation and Other?segment manufactures various power products, including solar cell batteries, power tillers, portable generators, grass cutters, outboard marine engines, water pumps, snow throwers, power carriers and sprayers, lawn mowers and tractors.

Number of Employees: 194,173 |

|

|

| |

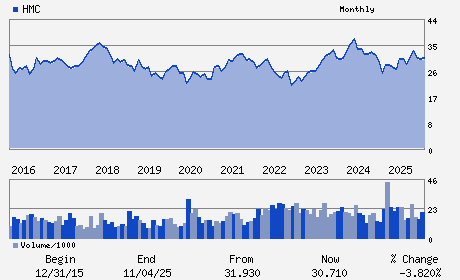

| • Price / Volume Information |

| Yesterday's Closing Price: $30.16 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,047,056 shares |

| Shares Outstanding: 1,560.85 (millions) |

| Market Capitalization: $47,075.38 (millions) |

| Beta: 0.37 |

| 52 Week High: $34.89 |

| 52 Week Low: $24.56 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-0.56% |

0.31% |

| 12 Week |

2.48% |

2.35% |

| Year To Date |

2.31% |

1.81% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

No. 2-3 Toranomon 2-chome Minato-ku

-

Tokyo,M0 105-8404

JPN |

ph: 813-5412-1134

fax: - |

None |

None |

|

|

| |

| • General Corporate Information |

Officers

Toshihiro Mibe - President and Chief Executive Officer

Eiji Fujimura - Chief Financial Officer;

Noriya Kaihara - Executive Vice President

Eiji Fujimura - Director

Asako Suzuki - Director

|

|

Peer Information

Honda Motor Co., Ltd. (DIN.L)

Honda Motor Co., Ltd. (SSM)

Honda Motor Co., Ltd. (FIATY)

Honda Motor Co., Ltd. (FUJHY)

Honda Motor Co., Ltd. (BAMXF)

Honda Motor Co., Ltd. (BRDCY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: AUTO -FOREIGN

Sector: Auto/Tires/Trucks

CUSIP: 438128308

SIC: 3711

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/12/26

|

|

Share - Related Items

Shares Outstanding: 1,560.85

Most Recent Split Date: 1.00 (4.00:1)

Beta: 0.37

Market Capitalization: $47,075.38 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.45% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $1.04 |

| Current Fiscal Year EPS Consensus Estimate: $1.86 |

Payout Ratio: 0.41 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.11 |

| Estmated Long-Term EPS Growth Rate: 8.35% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/12/26 |

|

|

|

| |