| Zacks Company Profile for Hoya Corp. (HOCPY : OTC) |

|

|

| |

| • Company Description |

| Hoya Corporation is a specialty manufacturer of optical glass. The Company's business activities include information technology, eye care, medical, and imaging systems. Its information technologies products include mask blanks and photomasks for semiconductor and LCD, glass memory disks, optical lenses, laser equipment and glass for electronic materials. Its eye care segment includes eyeglass lenses, contact lenses and intraocular lenses while the medical segment includes endoscopic imaging devices and hydroxyapatite. The Company's imaging system offers digital cameras and CCTV lenses. It also offers system architecture, crystal products, surveying instruments. Hoya Corporation is based in Tokyo, Japan.

Number of Employees: 37,909 |

|

|

| |

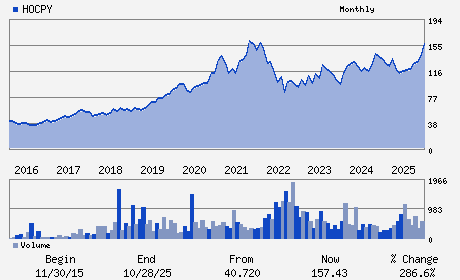

| • Price / Volume Information |

| Yesterday's Closing Price: $180.16 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 50,518 shares |

| Shares Outstanding: 338.41 (millions) |

| Market Capitalization: $60,968.73 (millions) |

| Beta: 1.00 |

| 52 Week High: $189.16 |

| 52 Week Low: $97.49 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

7.30% |

8.23% |

| 12 Week |

16.60% |

16.45% |

| Year To Date |

18.80% |

18.22% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

6-10-1 Nishi-Shinjuku Shinjuku-ku

-

Tokyo,M0 160-8347

JPN |

ph: 813-6911-4811

fax: - |

None |

http://www.hoya.com |

|

|

| |

| • General Corporate Information |

Officers

Eiichiro Ikeda - Chief Executive Officer and President

Ryo Hirooka - Chief Financial Officer

Eiichiro Ikeda - Director

Hiroaki Yoshihara - Director

Yasuyuki Abe - Director

|

|

Peer Information

Hoya Corp. (REFR)

Hoya Corp. (BELFA)

Hoya Corp. (DIPC)

Hoya Corp. (V.SSC)

Hoya Corp. (BNSOF)

Hoya Corp. (CUB.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC PRODS-MISC

Sector: Computer and Technology

CUSIP: 443251103

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 338.41

Most Recent Split Date: (:1)

Beta: 1.00

Market Capitalization: $60,968.73 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.69% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $1.23 |

| Current Fiscal Year EPS Consensus Estimate: $4.22 |

Payout Ratio: 0.25 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.05 |

| Estmated Long-Term EPS Growth Rate: 11.56% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |