| Zacks Company Profile for Home BancShares, Inc. (HOMB : NYSE) |

|

|

| |

| • Company Description |

| HOME BANCSHARES, INC. is a bank holding company, headquartered in Conway, Arkansas, with six wholly owned bank subsidiaries that provide a broad range of commercial and retail banking and related financial services to businesses, real estate developers and investors, individuals and municipalities. Three of the bank subsidiaries are located in the central Arkansas market area, a fourth serves central and southern Arkansas, a fifth serves Stone County in north central Arkansas, and a sixth serves the Florida Keys and southwestern Florida.

Number of Employees: 2,552 |

|

|

| |

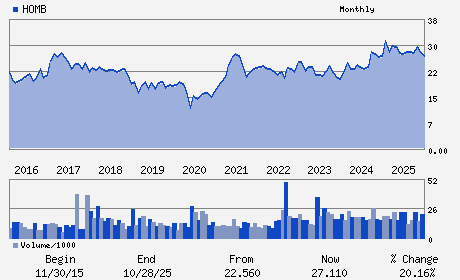

| • Price / Volume Information |

| Yesterday's Closing Price: $27.97 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,259,673 shares |

| Shares Outstanding: 196.63 (millions) |

| Market Capitalization: $5,499.86 (millions) |

| Beta: 0.78 |

| 52 Week High: $30.83 |

| 52 Week Low: $24.22 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-4.25% |

-2.93% |

| 12 Week |

-1.51% |

-2.02% |

| Year To Date |

0.68% |

0.16% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

719 Harkrider Suite 100

-

Conway,AR 72032

USA |

ph: 501-339-2929

fax: 501-328-4679 |

None |

http://www.homebancshares.com |

|

|

| |

| • General Corporate Information |

Officers

John W. Allison - Chairman of the Board of Directors and Chief Exe

Jack E. Engelkes - Vice Chairman of the Board

Brian S. Davis - Chief Financial Officer; Treasurer and Director

Jennifer C. Floyd - Chief Accounting Officer

Thomas J. Longe - Director

|

|

Peer Information

Home BancShares, Inc. (TSFG)

Home BancShares, Inc. (ABCB)

Home BancShares, Inc. (CFNL)

Home BancShares, Inc. (CPKF)

Home BancShares, Inc. (HIB)

Home BancShares, Inc. (FVB)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BANKS-SOUTHEAST

Sector: Finance

CUSIP: 436893200

SIC: 6022

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/15/26

|

|

Share - Related Items

Shares Outstanding: 196.63

Most Recent Split Date: 6.00 (2.00:1)

Beta: 0.78

Market Capitalization: $5,499.86 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.60 |

Indicated Annual Dividend: $0.84 |

| Current Fiscal Year EPS Consensus Estimate: $2.54 |

Payout Ratio: 0.36 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.01 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/11/2026 - $0.21 |

| Next EPS Report Date: 04/15/26 |

|

|

|

| |