| Zacks Company Profile for Robinhood Markets, Inc. (HOOD : NSDQ) |

|

|

| |

| • Company Description |

| Robinhood Financial LLC is a registered broker dealer. Robinhood Securities, LLC provides brokerage clearing services. Robinhood Crypto, LLC provides crypto currency trading. All are subsidiaries of Robinhood Markets, Inc.

Number of Employees: 2,900 |

|

|

| |

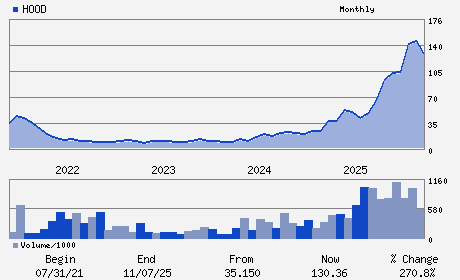

| • Price / Volume Information |

| Yesterday's Closing Price: $75.85 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 38,194,616 shares |

| Shares Outstanding: 900.31 (millions) |

| Market Capitalization: $68,288.39 (millions) |

| Beta: 2.47 |

| 52 Week High: $153.86 |

| 52 Week Low: $29.66 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-23.75% |

-23.09% |

| 12 Week |

-42.52% |

-42.59% |

| Year To Date |

-32.94% |

-33.26% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Vladimir Tenev - Chief Executive Officer and President

Shiv Verma - Chief Financial Officer

Baiju Bhatt - Director

Paula Loop - Director

Jonathan Rubinstein - Director

|

|

Peer Information

Robinhood Markets, Inc. (HDHL)

Robinhood Markets, Inc. (AGE.)

Robinhood Markets, Inc. (DIR)

Robinhood Markets, Inc. (SIEB)

Robinhood Markets, Inc. (OPY)

Robinhood Markets, Inc. (FFGI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FIN-INVEST BKRS

Sector: Finance

CUSIP: 770700102

SIC: 6211

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 900.31

Most Recent Split Date: (:1)

Beta: 2.47

Market Capitalization: $68,288.39 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.55 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $2.36 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 9.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 20.95% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |