| Zacks Company Profile for Henry Schein, Inc. (HSIC : NSDQ) |

|

|

| |

| • Company Description |

| Henry Schein Inc. is a leading distributor of health care products and services across the globe. The company serves office-based dental, medical and animal health practitioners, dental laboratories, government as well as institutional health care clinics and other alternate-care sites. Henry Schein's 3 businesses - Dental, Medical and Technology and Value-Added Services serve millions of customers worldwide. Henry Schein has completed the spinoff of its global Animal Health business. The global dental group serves office-based dental practitioners, dental laboratories, schools and other institutions. The global medical group serves office-based medical practitioners, ambulatory surgery centers, other alternate-care settings and other institutions. The global technology and value-added services group provides software, technology and other value-added services to health care practitioners. The technology group offerings include practice management software systems for dental and medical practitioners.

Number of Employees: 25,000 |

|

|

| |

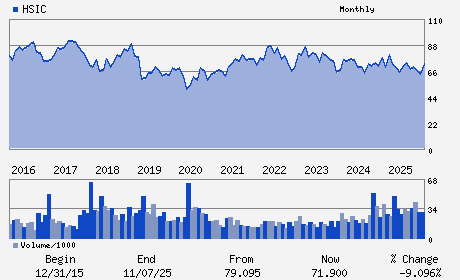

| • Price / Volume Information |

| Yesterday's Closing Price: $82.39 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,595,267 shares |

| Shares Outstanding: 114.70 (millions) |

| Market Capitalization: $9,450.47 (millions) |

| Beta: 0.87 |

| 52 Week High: $89.29 |

| 52 Week Low: $60.56 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

9.15% |

10.11% |

| 12 Week |

11.91% |

11.77% |

| Year To Date |

9.01% |

8.48% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Stanley M. Bergman - Chief Executive Officer; Chairman and Director

Michael S. Ettinger - Chief Operating Officer and Executive Vice Preside

Ronald N. South - Chief Financial Officer and Senior Vice President

William K. Daniel - Director

Deborah Derby - Director

|

|

Peer Information

Henry Schein, Inc. (ITRJ)

Henry Schein, Inc. (BRLI.)

Henry Schein, Inc. (GOGY)

Henry Schein, Inc. (PSTX.)

Henry Schein, Inc. (ELGXQ)

Henry Schein, Inc. (CAH)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED/DENTAL-SUPP

Sector: Medical

CUSIP: 806407102

SIC: 5047

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/04/26

|

|

Share - Related Items

Shares Outstanding: 114.70

Most Recent Split Date: 9.00 (2.00:1)

Beta: 0.87

Market Capitalization: $9,450.47 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.20 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $5.30 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 10.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 6.38% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/04/26 |

|

|

|

| |