| Zacks Company Profile for Host Hotels & Resorts, Inc. (HST : NSDQ) |

|

|

| |

| • Company Description |

| Host Hotels & Resorts, Inc. (HST) is the largest lodging real estate investment trust (REIT) and one of the largest owners of luxury and upper-upscale hotels. HST was incorporated as a Maryland corporation and operates as a self-managed and self-administered REIT. The Company is headquartered in Bethesda, Maryland. HST is the preeminent owner of high-quality lodging real estate at the epicenter of dynamic and growing markets. HST overall goal is to generate superior long-term risk-adjusted returns for stockholders. The Company guided by a disciplined approach to capital allocation and aggressive asset management, the Company partners with premium brands such as Marriott, Ritz-Carlton, Westin, Sheraton, W, St. Regis, Le Meridien, The Luxury Collection, Hyatt, Fairmont, Hilton, Swiss?tel, ibis, Pullman, and Novotel as well as independent brands in the operation of properties in over major markets.

Number of Employees: 162 |

|

|

| |

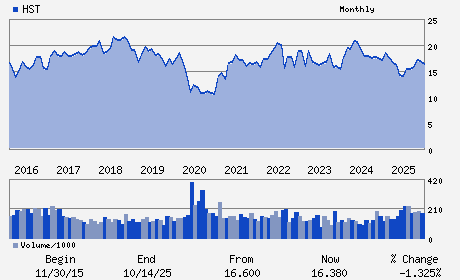

| • Price / Volume Information |

| Yesterday's Closing Price: $19.59 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 8,599,130 shares |

| Shares Outstanding: 687.80 (millions) |

| Market Capitalization: $13,474.04 (millions) |

| Beta: 1.13 |

| 52 Week High: $21.00 |

| 52 Week Low: $12.22 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

5.72% |

6.64% |

| 12 Week |

13.50% |

13.36% |

| Year To Date |

10.49% |

9.95% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

4747 BETHESDA AVENUE SUITE 1300

-

BETHESDA,MD 20814

USA |

ph: 240-744-1000

fax: 240-744-5125 |

ir@hosthotels.com |

http://www.hosthotels.com |

|

|

| |

| • General Corporate Information |

Officers

James F. Risoleo - Chief Executive Officer and President

Richard E. Marriott - Chairman

Sourav Ghosh - Chief Financial Officer and Executive Vice Preside

Joseph C. Ottinger - Senior Vice President and Corporate Controller

Mary L. Baglivo - Director

|

|

Peer Information

Host Hotels & Resorts, Inc. (ARE)

Host Hotels & Resorts, Inc. (CUZ)

Host Hotels & Resorts, Inc. (FUR)

Host Hotels & Resorts, Inc. (NNN)

Host Hotels & Resorts, Inc. (FCH)

Host Hotels & Resorts, Inc. (CTO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: REIT-EQTY TRUST -OTHER

Sector: Finance

CUSIP: 44107P104

SIC: 6798

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 687.80

Most Recent Split Date: 6.00 (5.00:1)

Beta: 1.13

Market Capitalization: $13,474.04 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 4.08% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.61 |

Indicated Annual Dividend: $0.80 |

| Current Fiscal Year EPS Consensus Estimate: $2.08 |

Payout Ratio: 0.38 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: 0.09 |

| Estmated Long-Term EPS Growth Rate: 4.15% |

Last Dividend Paid: 12/31/2025 - $0.35 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |