| Zacks Company Profile for Hub Group, Inc. (HUBG : NSDQ) |

|

|

| |

| • Company Description |

| Hub Group, Inc. is a transportation management company that provides multi-modal solutions throughout North America, including intermodal, truck brokerage, dedicated and logistics services. The company is one of the largest over-the-road brokers in North America. The Company arranges for the movement of its customers' freight in containers and trailers over long distances. Hub Group operates through a nationwide network of hubs, located near significant concentrations of shipping customers and railheads. As a publicly traded company, Hub Group delivers innovative, customer-focused solutions and industry leading service to help customers better control supply chains and their costs. It operates through a nationwide network of hubs, located near significant concentrations of shipping customers and railheads. The company is headquartered in Cambridge, MA.

Number of Employees: 6,500 |

|

|

| |

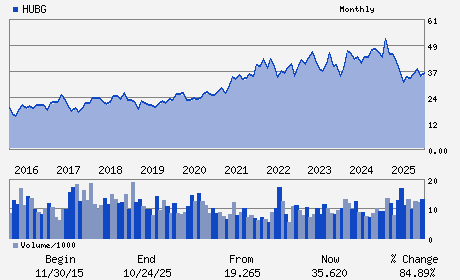

| • Price / Volume Information |

| Yesterday's Closing Price: $43.00 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,391,214 shares |

| Shares Outstanding: 61.15 (millions) |

| Market Capitalization: $2,629.60 (millions) |

| Beta: 1.14 |

| 52 Week High: $53.26 |

| 52 Week Low: $30.75 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-13.45% |

-12.25% |

| 12 Week |

4.42% |

3.89% |

| Year To Date |

0.92% |

0.39% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Phillip D. Yeager - Vice Chairman of the Board of Directors; President

David P. Yeager - Executive Chairman of the Board of Directors

Kevin W. Beth - Executive Vice President; Chief Financial Officer

Brent M. Rhodes - Executive Vice President and Chief Accounting Offi

Mary H. Boosalis - Director

|

|

Peer Information

Hub Group, Inc. (HKAEY)

Hub Group, Inc. (UHAL)

Hub Group, Inc. (LYNG)

Hub Group, Inc. (MATX)

Hub Group, Inc. (GLC)

Hub Group, Inc. (FAVS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: TRANS-SERVICES

Sector: Transportation

CUSIP: 443320106

SIC: 4731

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/05/26

|

|

Share - Related Items

Shares Outstanding: 61.15

Most Recent Split Date: 1.00 (2.00:1)

Beta: 1.14

Market Capitalization: $2,629.60 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.16% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.36 |

Indicated Annual Dividend: $0.50 |

| Current Fiscal Year EPS Consensus Estimate: $1.99 |

Payout Ratio: 0.27 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: 0.18 |

| Estmated Long-Term EPS Growth Rate: 15.96% |

Last Dividend Paid: 12/05/2025 - $0.12 |

| Next EPS Report Date: 02/05/26 |

|

|

|

| |