| Zacks Company Profile for Howmet Aerospace Inc. (HWM : NYSE) |

|

|

| |

| • Company Description |

| Howmet Aerospace Inc. engages in providing engineered solutions for customers in the transportation, gas turbine and aerospace (both defense and commercial) industries world wide. It offers forged wheels under the Alcoa Wheels brand & surface treatment under the Dura-Bright brand. It also provides aerospace fastening systems, components used in jet engines and structural parts made of titanium used in defense and aerospace applications. It has 4 reportable business segments. Engine Products engages in manufacturing & providing investment castings including seamless rolled rings & airfoils as well as structural and rotating parts. Fastening Systems manufactures & markets fasteners, fluid fittings, bearings, latches and installation systems. Engineered Structures manufactures & markets mill products, titanium ingots, titanium forgings, extrusions forming, aluminum forgings, aluminum machined components and other products. Forged Wheels manufactures and markets forged aluminum trailer, truck and bus wheels, etc.

Number of Employees: 25,430 |

|

|

| |

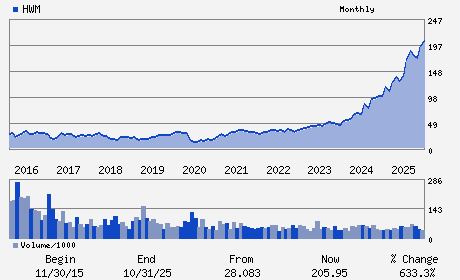

| • Price / Volume Information |

| Yesterday's Closing Price: $262.53 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,809,071 shares |

| Shares Outstanding: 400.94 (millions) |

| Market Capitalization: $105,258.80 (millions) |

| Beta: 1.20 |

| 52 Week High: $267.31 |

| 52 Week Low: $105.04 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

26.17% |

27.27% |

| 12 Week |

37.47% |

37.29% |

| Year To Date |

28.05% |

27.43% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

John C. Plant - Chief Executive Officer and Executive Chairman

Patrick Winterlich - Executive Vice President and Chief Financial Offic

Barbara L. Shultz - Vice President and Controller

- - -

- - -

|

|

Peer Information

Howmet Aerospace Inc. (BA)

Howmet Aerospace Inc. (HOVR)

Howmet Aerospace Inc. (HWM)

Howmet Aerospace Inc. (LMT)

Howmet Aerospace Inc. (TOD)

Howmet Aerospace Inc. (TXT)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: AEROSP/DEFENSE

Sector: Aerospace

CUSIP: 443201108

SIC: 3350

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 400.94

Most Recent Split Date: 10.00 (0.33:1)

Beta: 1.20

Market Capitalization: $105,258.80 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.18% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.11 |

Indicated Annual Dividend: $0.48 |

| Current Fiscal Year EPS Consensus Estimate: $4.54 |

Payout Ratio: 0.13 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: 0.03 |

| Estmated Long-Term EPS Growth Rate: 23.75% |

Last Dividend Paid: 02/06/2026 - $0.12 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |