| Zacks Company Profile for Integra LifeSciences Holdings Corporation (IART : NSDQ) |

|

|

| |

| • Company Description |

| Integra LifeSciences is one of the world leaders in regenerative medicine. The company develops, manufactures and markets cost-effective surgical implants and medical instruments. The company now manufactures and sells products in the following two global reportable business segments: Codman Specialty Surgical (CSS) and Orthopedics and Tissue Technologies (OTT). The CSS business offers global, market-leading technologies, brands and instrumentation. The global commercial network includes clinical specialists, a large direct global sales force and strategic partnerships and distributors that serve hospitals, integrated health networks, group purchasing organizations, clinicians, surgery centers and health care providers in North America, South America, Europe, Asia Pacific, Middle East and Africa. The Tissue Technologies segment includes wound reconstruction and repair products, bone grafts and nerve and tendon repair products.

Number of Employees: 4,427 |

|

|

| |

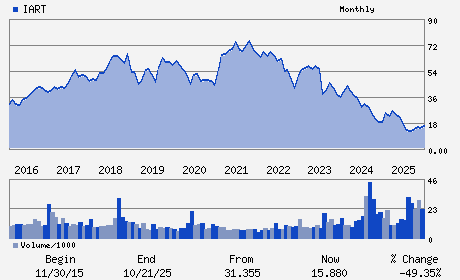

| • Price / Volume Information |

| Yesterday's Closing Price: $11.38 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 730,037 shares |

| Shares Outstanding: 77.89 (millions) |

| Market Capitalization: $886.35 (millions) |

| Beta: 1.02 |

| 52 Week High: $24.12 |

| 52 Week Low: $10.60 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

2.15% |

3.05% |

| 12 Week |

-14.05% |

-14.15% |

| Year To Date |

-8.37% |

-8.82% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Mojdeh Poul - President and Chief Executive Officer;

Stuart M. Essig - Chairman of the Board

Lea Knight - Executive Vice President and Chief Financial Offic

Jeffrey A. Mosebrook - Senior Vice President; Finance

Keith Bradley - Director

|

|

Peer Information

Integra LifeSciences Holdings Corporation (ABMD)

Integra LifeSciences Holdings Corporation (DMDS)

Integra LifeSciences Holdings Corporation (CPWY.)

Integra LifeSciences Holdings Corporation (EQUR)

Integra LifeSciences Holdings Corporation (ECIA)

Integra LifeSciences Holdings Corporation (FMS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED INSTRUMENTS

Sector: Medical

CUSIP: 457985208

SIC: 3841

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/04/26

|

|

Share - Related Items

Shares Outstanding: 77.89

Most Recent Split Date: 1.00 (2.00:1)

Beta: 1.02

Market Capitalization: $886.35 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.43 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $2.33 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/04/26 |

|

|

|

| |