| Zacks Company Profile for International Business Machines Corporation (IBM : NYSE) |

|

|

| |

| • Company Description |

| IBM is an information technology (IT) company. IBM has been divided into two parts: IBM and Kyndryl. IBM is addressing the hybrid cloud and AI opportunity with a platform-centric approach focused on providing two primary sources of client value: technology and business expertise. IBM provides integrated solutions and products that leverage data, information technology, deep expertise in industries and business processes, trust and security, and a broad ecosystem of partners and alliances. Its hybrid cloud platform and AI technology and services capabilities support clients? digital transformations and help the company engage with its customers and employees in new ways. The company operates in five segments: software, consulting, infrastructure, financing, and others. IBM purchased all of Red Hat, Inc.'s outstanding stock. Red Hat is reported within the Software segment, in Hybrid Platform & Solutions.

Number of Employees: 286,800 |

|

|

| |

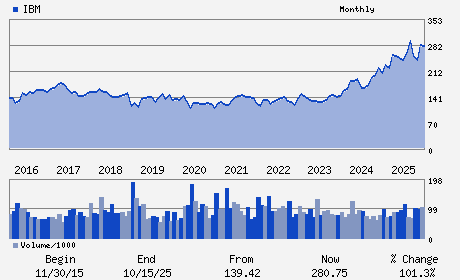

| • Price / Volume Information |

| Yesterday's Closing Price: $240.21 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 7,176,410 shares |

| Shares Outstanding: 938.03 (millions) |

| Market Capitalization: $225,325.25 (millions) |

| Beta: 0.73 |

| 52 Week High: $324.90 |

| 52 Week Low: $214.50 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-21.68% |

-20.99% |

| 12 Week |

-22.00% |

-22.09% |

| Year To Date |

-18.91% |

-19.30% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1 NEW ORCHARD ROAD

-

ARMONK,NY 10504

USA |

ph: 914-499-1900

fax: 914-765-6021 |

infoibm@us.ibm.com |

http://www.ibm.com |

|

|

| |

| • General Corporate Information |

Officers

Arvind Krishna - Chief Executive Officer; Chairman and President

James J. Kavanaugh - Chief Financial Officer and Senior Vice President

Nicolas A. Fehring - Vice President and Controller

Marianne C. Brown - Director

Thomas Buberl - Director

|

|

Peer Information

International Business Machines Corporation (AFFI)

International Business Machines Corporation (NQLIQ)

International Business Machines Corporation (CSPI)

International Business Machines Corporation (M.NXS)

International Business Machines Corporation (GTLL)

International Business Machines Corporation (FARO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: COMP-INTEGT SYS

Sector: Computer and Technology

CUSIP: 459200101

SIC: 3570

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/22/26

|

|

Share - Related Items

Shares Outstanding: 938.03

Most Recent Split Date: 5.00 (2.00:1)

Beta: 0.73

Market Capitalization: $225,325.25 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.80% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.78 |

Indicated Annual Dividend: $6.72 |

| Current Fiscal Year EPS Consensus Estimate: $12.37 |

Payout Ratio: 0.58 |

| Number of Estimates in the Fiscal Year Consensus: 9.00 |

Change In Payout Ratio: -0.11 |

| Estmated Long-Term EPS Growth Rate: 8.07% |

Last Dividend Paid: 02/10/2026 - $1.68 |

| Next EPS Report Date: 04/22/26 |

|

|

|

| |