| Zacks Company Profile for Infineon Technologies AG (IFNNY : OTC) |

|

|

| |

| • Company Description |

| Infineon Technologies designs, produces and sells semiconductors, themicrochips which have enabled the information age, and have led to avast increase in the speed, portability and capabilities of computers anda myriad other electronic devices. Infineon is active in providingapplication-oriented semiconductor solutions for use in sectors such asspeech and data communications, peripherals, wireless communications, automotive and industrial electronics, security and chip cards as well as memory products.

Number of Employees: 57,000 |

|

|

| |

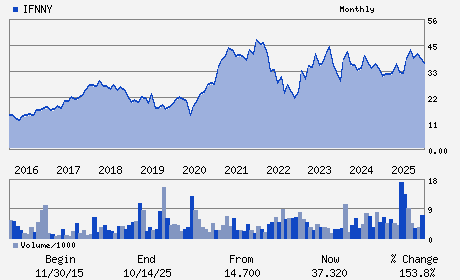

| • Price / Volume Information |

| Yesterday's Closing Price: $52.20 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 301,785 shares |

| Shares Outstanding: 1,228.50 (millions) |

| Market Capitalization: $64,127.92 (millions) |

| Beta: 1.77 |

| 52 Week High: $56.19 |

| 52 Week Low: $25.80 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

5.52% |

6.97% |

| 12 Week |

19.31% |

18.71% |

| Year To Date |

18.69% |

18.07% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Jochen Hanebeck - Chief Executive Officer

Herbert Diess - Chairman

Rutger Wijburg - Chief Operating Officer

Sven Schneider - Chief Financial Officer

Andreas Urschitz - Chief Marketing Officer

|

|

Peer Information

Infineon Technologies AG (CPCL.)

Infineon Technologies AG (HIFN)

Infineon Technologies AG (SEM.1)

Infineon Technologies AG (DION)

Infineon Technologies AG (AMKR)

Infineon Technologies AG (CNXT.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC COMP-SEMIC

Sector: Computer and Technology

CUSIP: 45662N103

SIC: 3674

|

|

Fiscal Year

Fiscal Year End: September

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 1,228.50

Most Recent Split Date: (:1)

Beta: 1.77

Market Capitalization: $64,127.92 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.53% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.41 |

Indicated Annual Dividend: $0.28 |

| Current Fiscal Year EPS Consensus Estimate: $1.86 |

Payout Ratio: 0.15 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: 0.03 |

| Estmated Long-Term EPS Growth Rate: 28.25% |

Last Dividend Paid: 02/23/2026 - $0.28 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |