| Zacks Company Profile for i3 Verticals, Inc. (IIIV : NSDQ) |

|

|

| |

| • Company Description |

| i3 Verticals, Inc. provides payment and software solutions. The Company offers electronic payment services to education, non-profit, public sector, property management and health care industries. i3 Verticals, Inc. is based in TN, United States.

Number of Employees: 1,202 |

|

|

| |

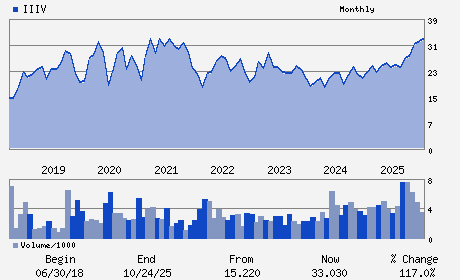

| • Price / Volume Information |

| Yesterday's Closing Price: $22.38 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 473,817 shares |

| Shares Outstanding: 30.48 (millions) |

| Market Capitalization: $682.05 (millions) |

| Beta: 0.97 |

| 52 Week High: $33.97 |

| 52 Week Low: $19.89 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

0.77% |

1.65% |

| 12 Week |

-3.58% |

-3.69% |

| Year To Date |

-11.15% |

-11.59% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Gregory Daily - Chief Executive Officer and Director

Geoff Smith - Chief Financial Officer

Clay Whitson - Chief Strategy Officer and Director

Elizabeth Seigenthaler Courtney - Director

John Harrison - Director

|

|

Peer Information

i3 Verticals, Inc. (ADP)

i3 Verticals, Inc. (CWLD)

i3 Verticals, Inc. (CYBA.)

i3 Verticals, Inc. (ZVLO)

i3 Verticals, Inc. (AZPN)

i3 Verticals, Inc. (ATIS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SOFTWARE

Sector: Computer and Technology

CUSIP: 46571Y107

SIC: 7389

|

|

Fiscal Year

Fiscal Year End: September

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 30.48

Most Recent Split Date: (:1)

Beta: 0.97

Market Capitalization: $682.05 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.18 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.69 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |