| Zacks Company Profile for Illumina, Inc. (ILMN : NSDQ) |

|

|

| |

| • Company Description |

| Illumina Inc. is a life sciences company, which provides tools and integrated systems for analysis of genetic variation and function. Using its proprietary technologies, the company provides innovative sequencing and array-based solutions for genotyping, copy number variation analysis, methylation studies, and gene expression profiling of DNA and RNA. Its customers include leading genomic research centers, academic institutions, government laboratories, hospitals and reference laboratories as well as pharmaceutical, biotechnology, agrigenomics, commercial molecular diagnostic and consumer genomics companies. Illumina generates revenue from two segments - Product and Service. Product are primarily attributed to the partnerships and collaborations to develop distributable clinical in-vitro diagnostics for Illumina sequencers. Service include genotyping and sequencing services as well as instrument maintenance contracts.

Number of Employees: 8,650 |

|

|

| |

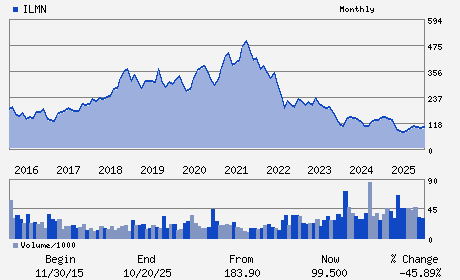

| • Price / Volume Information |

| Yesterday's Closing Price: $134.46 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,528,289 shares |

| Shares Outstanding: 152.90 (millions) |

| Market Capitalization: $20,558.93 (millions) |

| Beta: 1.45 |

| 52 Week High: $155.53 |

| 52 Week Low: $68.70 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-7.15% |

-6.34% |

| 12 Week |

4.26% |

4.14% |

| Year To Date |

2.52% |

2.02% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

5200 ILLUMINA WAY

-

SAN DIEGO,CA 92122

USA |

ph: 858-202-4500

fax: 858-202-4766 |

ir@illumina.com |

http://www.illumina.com |

|

|

| |

| • General Corporate Information |

Officers

Jacob Thaysen - Chief Executive Officer; Director

Scott Gottlieb - Independent Chair of the Board of Directors

Ankur Dhingra - Chief Financial Officer

Scott Ericksen - Vice President and Chief Accounting Officer

Frances Arnold - Director

|

|

Peer Information

Illumina, Inc. (CORR.)

Illumina, Inc. (RSPI)

Illumina, Inc. (CGXP)

Illumina, Inc. (BGEN)

Illumina, Inc. (GTBP)

Illumina, Inc. (RGRX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED-BIOMED/GENE

Sector: Medical

CUSIP: 452327109

SIC: 3826

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 152.90

Most Recent Split Date: 9.00 (2.00:1)

Beta: 1.45

Market Capitalization: $20,558.93 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.06 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $5.14 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 10.18% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |