| Zacks Company Profile for IMAX Corporation (IMAX : NYSE) |

|

|

| |

| • Company Description |

| IMAX Corporation is a leading global entertainment technology, specializing in motion picture technologies and presentations. It generates revenues primarily from four main groups: IMAX Technology Network, IMAX Technology Sales and Maintenance, New business and other. The company primarily offers IMAX Digital Re-Mastering (DMR) and IMAX Theater Systems. IMAX DMR digitally re-masters Hollywood films into IMAX digital cinema package format or 15/70-format film for exhibition in its theaters. It has signed IMAX with Laser agreements with leading, global exhibitors such as AMC Entertainment, CGV Holdings Limited, Cineworld Group, Les Cin?masPath? Gaumont and others. The company is also exploring new businesses like Home Entertainment and investing in original content. The company announced a new home entertainment licensing and certification program called IMAX Enhanced. Notable partners of the program were Sony Electronics, Sony Pictures, Paramount Pictures and Sound United.

Number of Employees: 700 |

|

|

| |

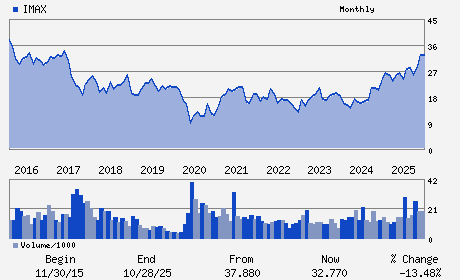

| • Price / Volume Information |

| Yesterday's Closing Price: $42.02 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,109,059 shares |

| Shares Outstanding: 53.99 (millions) |

| Market Capitalization: $2,268.79 (millions) |

| Beta: 0.33 |

| 52 Week High: $43.16 |

| 52 Week Low: $20.48 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

19.61% |

21.26% |

| 12 Week |

9.14% |

8.59% |

| Year To Date |

13.69% |

13.09% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Richard L. Gelfond - Chief Executive Officer & Director

Darren D. Throop - Chairman

Natasha Fernandes - Chief Financial Officer & Executive Vice-President

Gail Berman - Director

Kevin Douglas - Director

|

|

Peer Information

IMAX Corporation (BDLN)

IMAX Corporation (M.IMX)

IMAX Corporation (AFTC.)

IMAX Corporation (CELC.)

IMAX Corporation (CCTVY)

IMAX Corporation (NLMP)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MOVIE/TV PRD&DIST

Sector: Consumer Discretionary

CUSIP: 45245E109

SIC: 3861

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/22/26

|

|

Share - Related Items

Shares Outstanding: 53.99

Most Recent Split Date: 5.00 (2.00:1)

Beta: 0.33

Market Capitalization: $2,268.79 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.19 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.21 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 16.75% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/22/26 |

|

|

|

| |