| Zacks Company Profile for Immunovant, Inc. (IMVT : NSDQ) |

|

|

| |

| • Company Description |

| Immunovant, Inc. is a clinical-stage biopharmaceutical company, which develops monoclonal antibodies for the treatment of autoimmune diseases. It is developing batoclimab, a novel, fully-human monoclonal antibody that selectively binds to and inhibits the neonatal fragment crystallizable receptor. The company is developing batoclimabas a fixed-dose subcutaneous injection for the treatment of autoimmune diseases. It's developing batoclimab with an initial focus on the treatment of myasthenia gravis, an autoimmune disease; thyroid eye disease; and warm autoimmune hemolyticanemia. Immunovant, Inc. is a subsidiary of Roivant Sciences Ltd. (RSL). Roivant Sciences GmbH (RSG), a wholly-owned subsidiary of RSL, entered into the HanAll agreement. Per the agreement, RSG received the non-exclusive right to manufacture and exclusively develop, import and use batoclimaband commercialize it in the United States, the EU during the term of the agreement.

Number of Employees: 362 |

|

|

| |

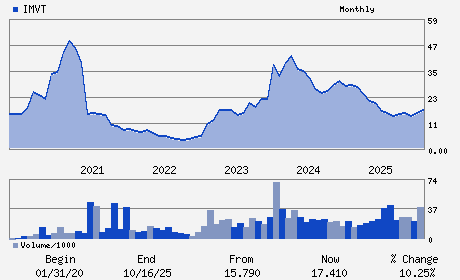

| • Price / Volume Information |

| Yesterday's Closing Price: $27.73 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,311,420 shares |

| Shares Outstanding: 203.53 (millions) |

| Market Capitalization: $5,643.95 (millions) |

| Beta: 0.61 |

| 52 Week High: $29.25 |

| 52 Week Low: $12.72 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

6.65% |

7.59% |

| 12 Week |

21.41% |

21.26% |

| Year To Date |

9.09% |

8.56% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Eric Venker - Chief Executive Officer

Frank M. Torti - Executive Chairperson

Tiago Girao - Chief Financial Officer

Jacob Bauer - Director

Andrew Fromkin - Director

|

|

Peer Information

- (-)

- (-)

- (-)

- (-)

- (-)

- (-)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED-BIOMED/GENE

Sector: Medical

CUSIP: 45258J102

SIC: 2836

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 06/04/26

|

|

Share - Related Items

Shares Outstanding: 203.53

Most Recent Split Date: (:1)

Beta: 0.61

Market Capitalization: $5,643.95 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.61 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-2.67 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 11.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 06/04/26 |

|

|

|

| |