| Zacks Company Profile for American Noble Gas Inc. (INFY : NYSE) |

|

|

| |

| • Company Description |

| Infosys Technologies enables its clients to leverage its performance by utilizing its proprietary Global Delivery Model. Infosys operates across the following business segments - Financial Services, Retail, Communication, Energy, Utilities, resources & Services, Manufacturing, Hi Tech, Life Sciences and Others. Some of the services offered by the company are: Business Process Management Services and IT Consulting. Infosys, through its subsidiary Progeon, Ltd., offers its customers the chance to outsource several process-intensive functions related to Customer Relationship Management, Finance and Accounting and Administration and Sales Order Processing. Infosys' consultants offer technical advice in developing and recommending appropriate IT architecture, hardware and software to deliver IT solutions designed to meet specific business needs of its clients.

Number of Employees: 323,578 |

|

|

| |

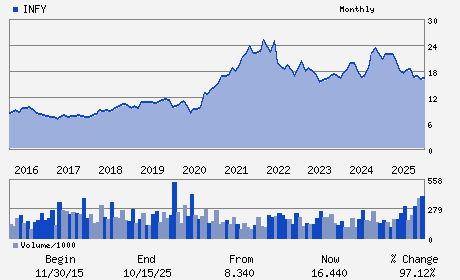

| • Price / Volume Information |

| Yesterday's Closing Price: $14.19 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 18,558,406 shares |

| Shares Outstanding: 4,045.68 (millions) |

| Market Capitalization: $57,408.25 (millions) |

| Beta: 1.01 |

| 52 Week High: $20.22 |

| 52 Week Low: $13.66 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-22.63% |

-21.56% |

| 12 Week |

-19.92% |

-20.33% |

| Year To Date |

-20.37% |

-20.79% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Salil Parekh - Chief Executive officer and Managing Director

Nandan M. Nilekani - Chairman

Jayesh Sanghrajka - Chief Financial Officer

Inderpreet Sawhney - Chief Legal Officer and Chief Compliance Officer

D. Sundaram - Director

|

|

Peer Information

American Noble Gas Inc. (UIS)

American Noble Gas Inc. (CTSH)

American Noble Gas Inc. (ASGN)

American Noble Gas Inc. (GTTNQ)

American Noble Gas Inc. (DXC)

American Noble Gas Inc. (DOX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: IT Services

Sector: Computer and Technology

CUSIP: 456788108

SIC: 7371

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/16/26

|

|

Share - Related Items

Shares Outstanding: 4,045.68

Most Recent Split Date: 9.00 (2.00:1)

Beta: 1.01

Market Capitalization: $57,408.25 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.11% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.21 |

Indicated Annual Dividend: $0.44 |

| Current Fiscal Year EPS Consensus Estimate: $0.78 |

Payout Ratio: 0.55 |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: 0.02 |

| Estmated Long-Term EPS Growth Rate: 8.56% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/16/26 |

|

|

|

| |