| Zacks Company Profile for Inspired Entertainment, Inc. (INSE : NSDQ) |

|

|

| |

| • Company Description |

| Inspired Entertainment, Inc. is a games technology company. It engaged in supplying Virtual Sports, Mobile Gaming and Server-Based Gaming systems to regulated lottery, betting and gaming operators. Inspired Entertainment Inc., formerly known as Hydra Industries Acquisition Corp, is based in New York.

Number of Employees: 1,600 |

|

|

| |

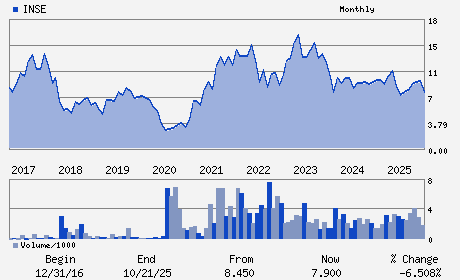

| • Price / Volume Information |

| Yesterday's Closing Price: $8.22 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 60,848 shares |

| Shares Outstanding: 26.93 (millions) |

| Market Capitalization: $221.34 (millions) |

| Beta: 1.23 |

| 52 Week High: $10.29 |

| 52 Week Low: $6.51 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-10.56% |

-9.32% |

| 12 Week |

-9.07% |

-9.53% |

| Year To Date |

-12.18% |

-12.64% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

250 West 57th Street Suite 415

-

New York,NY 10107

USA |

ph: 646-565-3861

fax: - |

ir@inseinc.com |

http://www.inseinc.com |

|

|

| |

| • General Corporate Information |

Officers

A. Lorne Weil - Executive Chairman

James Richardson - Chief Financial Officer

Michael R. Chambrello - Director

Ira H. Raphaelson - Director

Desiree G. Rogers - Director

|

|

Peer Information

Inspired Entertainment, Inc. (EVOL)

Inspired Entertainment, Inc. (RAMP)

Inspired Entertainment, Inc. (LGTY)

Inspired Entertainment, Inc. (ALOT)

Inspired Entertainment, Inc. (CXT)

Inspired Entertainment, Inc. (TGHI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Technology Services

Sector: Business Services

CUSIP: 45782N108

SIC: 7372

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/10/26

|

|

Share - Related Items

Shares Outstanding: 26.93

Most Recent Split Date: (:1)

Beta: 1.23

Market Capitalization: $221.34 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.00 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.54 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/10/26 |

|

|

|

| |