| Zacks Company Profile for Intel Corporation (INTC : NSDQ) |

|

|

| |

| • Company Description |

| Intel Corporation, one of the world's largest semiconductor company and primary supplier of microprocessors and chipsets, is gradually moving into data-centric businesses such as AI and autonomous driving. Intel is a dominant player for microprocessors in both consumer and enterprise markets. Data Center Group, Internet of Things Group, Mobileye, Non-Volatile memory solutions group and Programmable solutions Group and All Other business units form the crux of Intel's data-centric business model. DCG segment deals with servers, workstations and other products for cloud, enterprise, and communication infrastructure market. IOTG offers high-performance compute solutions and embedded applications. PSG segment offers programmable semiconductors, primarily FPGAs and structured ASICs. Mobileye is engaged in developing computer vision and machine learning-based sensing, data analysis, localization, mapping, and driving policy technology for ADAS and autonomous driving.

Number of Employees: 85,100 |

|

|

| |

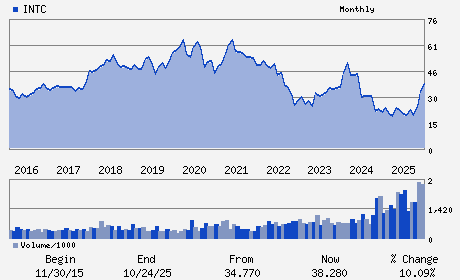

| • Price / Volume Information |

| Yesterday's Closing Price: $45.61 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 85,982,856 shares |

| Shares Outstanding: 4,995.00 (millions) |

| Market Capitalization: $227,821.95 (millions) |

| Beta: 1.37 |

| 52 Week High: $54.60 |

| 52 Week Low: $17.67 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-1.85% |

-0.99% |

| 12 Week |

10.14% |

10.01% |

| Year To Date |

23.60% |

23.00% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Lip-Bu Tan - Chief Executive Officer

Frank D. Yeary - Chairman

Nagasubramaniyan Chandrasekaran - Executive Vice President and Chief Technology and

David Zinsner - Executive Vice President and Chief Financial Offic

April Miller Boise - Executive Vice President and Chief Legal Officer

|

|

Peer Information

Intel Corporation (XCRA)

Intel Corporation (INTC)

Intel Corporation (NVDA)

Intel Corporation (TXN)

Intel Corporation (ISIL)

Intel Corporation (SUOPY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: SEMI-GENERAL

Sector: Computer and Technology

CUSIP: 458140100

SIC: 3674

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/23/26

|

|

Share - Related Items

Shares Outstanding: 4,995.00

Most Recent Split Date: 7.00 (2.00:1)

Beta: 1.37

Market Capitalization: $227,821.95 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.11 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.06 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 18.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 42.23% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/23/26 |

|

|

|

| |