| Zacks Company Profile for Itron, Inc. (ITRI : NSDQ) |

|

|

| |

| • Company Description |

| Itron Inc., is a technology company and one of the leading global suppliers of a wide range of standard, advanced, and smart meters and meter communication systems, including networks and communication modules, software, devices, sensors, data analytics and services. On the back of the diverse offerings, the company provides industrial Internet of Things (IoT) to support utilities and municipalities in the operations of their critical infrastructure. The company generates revenues from three operating segments namely Device Solutions, Networked Solutions and Outcomes.

Number of Employees: 5,550 |

|

|

| |

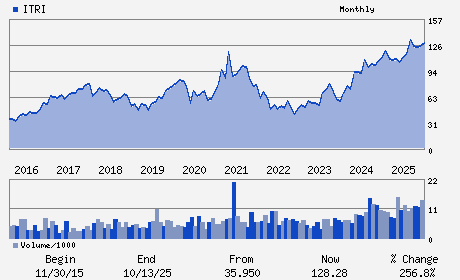

| • Price / Volume Information |

| Yesterday's Closing Price: $93.95 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,385,734 shares |

| Shares Outstanding: 44.94 (millions) |

| Market Capitalization: $4,222.23 (millions) |

| Beta: 1.44 |

| 52 Week High: $142.00 |

| 52 Week Low: $88.57 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-5.18% |

-4.35% |

| 12 Week |

-4.01% |

-4.12% |

| Year To Date |

1.17% |

0.68% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

2111 N MOLTER ROAD

-

LIBERTY LAKE,WA 99019

USA |

ph: 509-924-9900

fax: 509-891-3355 |

investors@itron.com |

http://www.itron.com |

|

|

| |

| • General Corporate Information |

Officers

Thomas L. Deitrich - President and Chief Executive Officer

Diana D. Tremblay - Chairman

Joan S. Hooper - Senior Vice President and Chief Financial Officer

David M. Wright - Vice President; Corporate Controller and Chief Acc

Scott Drury - Director

|

|

Peer Information

Itron, Inc. (AHIX)

Itron, Inc. (ITRI)

Itron, Inc. (AME)

Itron, Inc. (FTV)

Itron, Inc. (NATI)

Itron, Inc. (PRTKQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC TEST EQUIPTMENT

Sector: Computer and Technology

CUSIP: 465741106

SIC: 3825

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 44.94

Most Recent Split Date: (:1)

Beta: 1.44

Market Capitalization: $4,222.23 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.25 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $6.05 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 19.00% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |