| Zacks Company Profile for JAKKS Pacific, Inc. (JAKK : NSDQ) |

|

|

| |

| • Company Description |

| Jakks Pacific Inc is a multi-brand company that has been designing and marketing a broad range of toys and consumer products since 1995. The company recently re-aligned its products into two reporting segments to better reflect management and operation of its business. The company's segments are (i) Toys/Consumer Products & (ii) Halloween. The Toys/Consumer Products segment includes action figures, vehicles, play sets, plush products, dolls, electronic products, construction toys, infant & pre-school toys, role play & everyday costume play, foot to floor ride-on vehicles, wagons, novelty toys, seasonal and outdoor products, kids' indoor & outdoor furniture and related products. Within the Halloween segment, the company markets and sells Halloween costumes and accessories and everyday costume play products. The company's popular proprietary brands include MorfBoard, Perfectly Cute, Squish-Dee-Lish, TP Blaster, Disguise, Moose Mountain, Funnoodle, Maui, Kids Only and Cest Moi.

Number of Employees: 680 |

|

|

| |

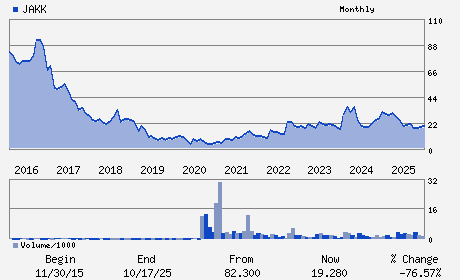

| • Price / Volume Information |

| Yesterday's Closing Price: $20.68 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 183,182 shares |

| Shares Outstanding: 11.44 (millions) |

| Market Capitalization: $236.67 (millions) |

| Beta: 1.58 |

| 52 Week High: $26.49 |

| 52 Week Low: $14.87 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

14.57% |

16.27% |

| 12 Week |

26.41% |

26.85% |

| Year To Date |

22.51% |

23.03% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

2951 28TH STREET

-

SANTA MONICA,CA 90405

USA |

ph: 424-268-9444

fax: 310-317-8527 |

investors@jakks.net |

http://www.jakks.com |

|

|

| |

| • General Corporate Information |

Officers

Stephen G. Berman - Chairman; Chief Executive Officer; President; Secr

John L. Kimble - Executive Vice President and Chief Financial Offi

Neilwantie Mahabir - Director

Alexander Shoghi - Director

Jonathan R. Liebman - Director

|

|

Peer Information

JAKKS Pacific, Inc. (EXEXA)

JAKKS Pacific, Inc. (HERE)

JAKKS Pacific, Inc. (SSTRF)

JAKKS Pacific, Inc. (ATN.)

JAKKS Pacific, Inc. (ATVI)

JAKKS Pacific, Inc. (JAKK)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: TOYS/GAME/HOBBY

Sector: Consumer Discretionary

CUSIP: 47012E403

SIC: 3944

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 11.44

Most Recent Split Date: 7.00 (0.10:1)

Beta: 1.58

Market Capitalization: $236.67 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 4.84% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.06 |

Indicated Annual Dividend: $1.00 |

| Current Fiscal Year EPS Consensus Estimate: $2.10 |

Payout Ratio: 1.23 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.99 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/27/2026 - $0.25 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |