| Zacks Company Profile for Jabil, Inc. (JBL : NYSE) |

|

|

| |

| • Company Description |

| Jabil Inc. provides electronic manufacturing services and solutions. The Company's operating segment includes Electronics Manufacturing Services (EMS) and Diversified Manufacturing Services (DMS). EMS segment is focused on leveraging information technology, supply chain design and engineering, technologies centered on core electronics. DMS segment is focused on providing engineering solutions and a focus on material sciences and technologies. It provides electronic design, production and product management services to automotive, capital equipment, consumer lifestyles and wearable technologies, computing and storage, defense and aerospace, digital home, emerging growth, industrial and energy, mobility, packaging, point of sale and printing industries. The company's largest customers included Apple, Cisco, Hewlett-Packard Company, Keysight Technologies, LM Ericsson, NetApp, Nokia Networks, SolarEdge Technologies, Valeo S.A. and Zebra Technologies.

Number of Employees: 135,000 |

|

|

| |

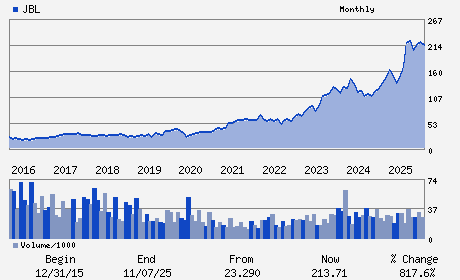

| • Price / Volume Information |

| Yesterday's Closing Price: $261.18 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,076,927 shares |

| Shares Outstanding: 105.60 (millions) |

| Market Capitalization: $27,579.37 (millions) |

| Beta: 1.22 |

| 52 Week High: $281.37 |

| 52 Week Low: $108.66 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

7.38% |

8.86% |

| 12 Week |

15.86% |

15.27% |

| Year To Date |

14.54% |

13.94% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Michael Dastoor - Chief Executive Officer

Mark T. Mondello - Chairman of the Board of Directors

Gregory B. Hebard - Chief Financial Officer

Steven A. Raymund - Lead Independent Director

Anousheh Ansari - Director

|

|

Peer Information

Jabil, Inc. (BHE)

Jabil, Inc. (JACO)

Jabil, Inc. (CLS)

Jabil, Inc. (SANM)

Jabil, Inc. (PLXS)

Jabil, Inc. (JBL)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC MANUF SVS (EMS)

Sector: Computer and Technology

CUSIP: 466313103

SIC: 3672

|

|

Fiscal Year

Fiscal Year End: August

Last Reported Quarter: 11/01/25

Next Expected EPS Date: 03/19/26

|

|

Share - Related Items

Shares Outstanding: 105.60

Most Recent Split Date: 3.00 (2.00:1)

Beta: 1.22

Market Capitalization: $27,579.37 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.12% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.70 |

Indicated Annual Dividend: $0.32 |

| Current Fiscal Year EPS Consensus Estimate: $10.61 |

Payout Ratio: 0.03 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: -0.02 |

| Estmated Long-Term EPS Growth Rate: 14.77% |

Last Dividend Paid: 02/17/2026 - $0.08 |

| Next EPS Report Date: 03/19/26 |

|

|

|

| |