| Zacks Company Profile for Jack Henry & Associates, Inc. (JKHY : NSDQ) |

|

|

| |

| • Company Description |

| Jack Henry & Associates, Inc. caters to community banks by offering technology solutions and payment processing services. Its products are available via its three business brands: Jack Henry Banking serves community banks, multi-billion-dollar institutions and many other financial institutions. ProfitStars offers highly specialized core agnostic products and services such as imaging and payments processing, information security and risk management, retail delivery, and online and mobile solutions. Its Core unit provides core information processing platforms to banks and credit unions via Jack Henry Banking & Symitar brands, with a variety of advanced banking service mechanisms. Complementary offers additional software and services that can be utilized independently or can be integrated with the company's core solutions. Corporate and Other unit includes hardware revenue and costs. It offers hardware such as IBM Power Systems, HP servers and workstations, and Digital Check.

Number of Employees: 7,400 |

|

|

| |

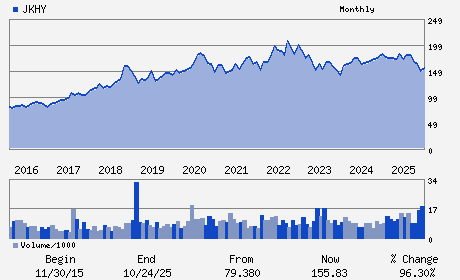

| • Price / Volume Information |

| Yesterday's Closing Price: $168.75 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,224,069 shares |

| Shares Outstanding: 72.17 (millions) |

| Market Capitalization: $12,178.24 (millions) |

| Beta: 0.72 |

| 52 Week High: $196.00 |

| 52 Week Low: $144.12 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

1.56% |

3.07% |

| 12 Week |

-6.34% |

-6.01% |

| Year To Date |

-7.52% |

-7.13% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Gregory R. Adelson - Chief Executive Officer and President

David B. Foss - Chairman

Matthew C. Flanigan - Vice Chairman

Mimi L. Carsley - Chief Financial Officer and Treasurer

Renee A. Swearingen - Senior Vice President

|

|

Peer Information

Jack Henry & Associates, Inc. (UIS)

Jack Henry & Associates, Inc. (CTSH)

Jack Henry & Associates, Inc. (ASGN)

Jack Henry & Associates, Inc. (GTTNQ)

Jack Henry & Associates, Inc. (DXC)

Jack Henry & Associates, Inc. (DOX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: IT Services

Sector: Computer and Technology

CUSIP: 426281101

SIC: 7373

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 72.17

Most Recent Split Date: 3.00 (2.00:1)

Beta: 0.72

Market Capitalization: $12,178.24 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.37% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.43 |

Indicated Annual Dividend: $2.32 |

| Current Fiscal Year EPS Consensus Estimate: $6.58 |

Payout Ratio: 0.33 |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: -0.07 |

| Estmated Long-Term EPS Growth Rate: 10.00% |

Last Dividend Paid: 12/02/2025 - $0.58 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |