| Zacks Company Profile for The Japan Steel Works, Ltd. (JPSWY : OTC) |

|

|

| |

| • Company Description |

| The Japan Steel Works, Ltd. is involved in producing industrial machinery. The company's business segments include Steel and Energy Products, Industrial Machinery Products and Real Estate and Other Businesses. Steel and Energy Products segment manufactures and sells iron and steel products, chemical machinery, nuclear power-related machinery, metallic mold, petroleum refinery, petrochemistry, general chemical products, pressure containers, clad plates, various steel pipes and wind generated power machinery. Industry Machinery segment manufactures and sells plastic injection machines, resin manufacturing and processing machinery, hollow molding machines, fluid machines, hydraulic equipment, electronic equipment and display manufacturing equipment, magnesium alloy injection machines and other machinery. Real Estate and Others segment is involved in the real estate leasing and development businesses. The Japan Steel Works, Ltd. is headquartered in Tokyo, Japan.

Number of Employees: 5,283 |

|

|

| |

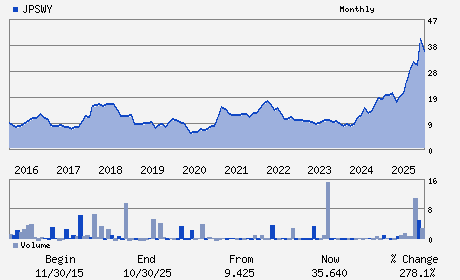

| • Price / Volume Information |

| Yesterday's Closing Price: $34.01 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 357 shares |

| Shares Outstanding: 147.22 (millions) |

| Market Capitalization: $5,007.01 (millions) |

| Beta: 0.27 |

| 52 Week High: $39.92 |

| 52 Week Low: $12.52 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

19.39% |

21.04% |

| 12 Week |

10.37% |

9.81% |

| Year To Date |

36.83% |

36.12% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

Gate City Ohsaki-West Tower Shinagawa

-

Tokyo,M0 141-0032

JPN |

ph: 813-5745-2011

fax: 813-5745-2025 |

None |

http://www.jsw.co.jp |

|

|

| |

| • General Corporate Information |

Officers

Toshio Matsuo - President; CEO & Representative Director

Hiroki Kikuchi - EVP; CFO; GM of Corporate Planning Office & Repres

Shigeki Inoue - Senior Managing Executive Officer; CTO; GM of Qual

Shoji Nunoshita - Director

Yoshiyuki Nakanishi - Director

|

|

Peer Information

The Japan Steel Works, Ltd. (B.)

The Japan Steel Works, Ltd. (DXPE)

The Japan Steel Works, Ltd. (AIT)

The Japan Steel Works, Ltd. (GDI.)

The Japan Steel Works, Ltd. (CTITQ)

The Japan Steel Works, Ltd. (EBCOY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MACH-GENL INDL

Sector: Industrial Products

CUSIP: 471100305

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/12/26

|

|

Share - Related Items

Shares Outstanding: 147.22

Most Recent Split Date: 10.00 (0.80:1)

Beta: 0.27

Market Capitalization: $5,007.01 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.50% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.17 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.21 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: -0.02 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/12/26 |

|

|

|

| |