| Zacks Company Profile for Kinross Gold Corporation (KGC : NYSE) |

|

|

| |

| • Company Description |

| Kinross Gold Corp. is primarily involved in the exploration and operation of gold mines and also is a leading gold mining company globally. The company's operations are located in three core regions: the Americas and West Africa. It holds major assets in Canada, the United States and Russia, and is primarily involved in the exploration and operation of gold mines. Kinross also produces and sells silver. It runs several mines, including Fort Knox, Round Mountain and Kettle River-Buckhorn in the United States, Dvoinoye and Kupol in Russia, Maricunga in Chile, and Paracatu in Brazil. The company's development projects include La Coipa in Chile and Tasiast in Mauritania. Kinross acquired subsidiary, Kinross Brasil Mineracao and hydroelectric power plants (Barra dos Coqueiros and Cacu) located in Brazil from a subsidiary of Gerdau SA. Moreover, strategic investment in core asset will further enhance and strengthen Paracatu, which is a cornerstone asset in the company's portfolio.

Number of Employees: 6,800 |

|

|

| |

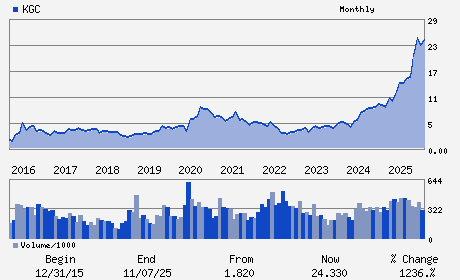

| • Price / Volume Information |

| Yesterday's Closing Price: $36.99 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 11,939,572 shares |

| Shares Outstanding: 1,199.84 (millions) |

| Market Capitalization: $44,382.20 (millions) |

| Beta: 0.73 |

| 52 Week High: $39.11 |

| 52 Week Low: $10.42 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

17.20% |

18.23% |

| 12 Week |

35.59% |

35.43% |

| Year To Date |

31.36% |

30.72% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

J. Paul Rollinson - Chief Executive Officer

Catherine McLeod-Seltzer - Chairman

Geoffrey P. Gold - President

Claude Schimper - Executive Vice-President and Chief Operating Offic

Andrea S. Freeborough - Executive Vice-President and Chief Financial Offic

|

|

Peer Information

Kinross Gold Corporation (MDWCQ)

Kinross Gold Corporation (JABI)

Kinross Gold Corporation (DRD)

Kinross Gold Corporation (SDMCF)

Kinross Gold Corporation (BENGF)

Kinross Gold Corporation (GBGLF)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MINING -GOLD

Sector: Basic Materials

CUSIP: 496902404

SIC: 1040

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 1,199.84

Most Recent Split Date: 2.00 (0.33:1)

Beta: 0.73

Market Capitalization: $44,382.20 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.38% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.62 |

Indicated Annual Dividend: $0.14 |

| Current Fiscal Year EPS Consensus Estimate: $2.69 |

Payout Ratio: 0.08 |

| Number of Estimates in the Fiscal Year Consensus: 9.00 |

Change In Payout Ratio: -0.20 |

| Estmated Long-Term EPS Growth Rate: 7.41% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |