| Zacks Company Profile for Kulicke and Soffa Industries, Inc. (KLIC : NSDQ) |

|

|

| |

| • Company Description |

| Kulicke & Soffa is a leading provider of semiconductor packaging and electronic assembly solutions supporting the global automotive, consumer, communications, computing and industrial segments. As a pioneer in the semiconductor space, K&S has provided customers with market leading packaging solutions for decades. In recent years, K&S has expanded its product offerings through strategic acquisitions and organic development, adding advanced packaging, electronics assembly, wedge bonding and a broader range of expendable tools to its core offerings. Combined with its extensive expertise in process technology and focus on development, K&S is well positioned to help customers meet the challenges of packaging and assembling the next-generation of electronic devices.

Number of Employees: 2,592 |

|

|

| |

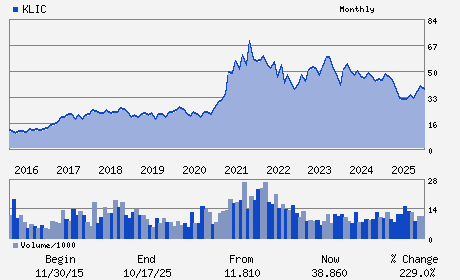

| • Price / Volume Information |

| Yesterday's Closing Price: $69.72 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 901,585 shares |

| Shares Outstanding: 52.33 (millions) |

| Market Capitalization: $3,648.21 (millions) |

| Beta: 1.57 |

| 52 Week High: $77.50 |

| 52 Week Low: $26.63 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

21.61% |

22.67% |

| 12 Week |

43.78% |

43.60% |

| Year To Date |

53.03% |

52.29% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

23A SERANGOON NORTH AVENUE 5 #01-01

-

SINGAPORE,U0 554369

SGP |

ph: 215-784-6000

fax: 65-6880-9580 |

investor@kns.com |

http://www.kns.com |

|

|

| |

| • General Corporate Information |

Officers

Lester Wong - Executive Vice President; Interim Chief Executive

Jon A. Olson - Director

Gregory F. Milzcik - Director

David J. Richardson - Director

Mui Sung Yeo - Director

|

|

Peer Information

Kulicke and Soffa Industries, Inc. (BESIY)

Kulicke and Soffa Industries, Inc. (NEXT2)

Kulicke and Soffa Industries, Inc. (EGLSQ)

Kulicke and Soffa Industries, Inc. (BTUI)

Kulicke and Soffa Industries, Inc. (DAWKQ)

Kulicke and Soffa Industries, Inc. (EMKR)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC-MANUFT MACH

Sector: Computer and Technology

CUSIP: 501242101

SIC: 3674

|

|

Fiscal Year

Fiscal Year End: September

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 52.33

Most Recent Split Date: 8.00 (2.00:1)

Beta: 1.57

Market Capitalization: $3,648.21 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.18% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.54 |

Indicated Annual Dividend: $0.82 |

| Current Fiscal Year EPS Consensus Estimate: $2.22 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/18/2025 - $0.20 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |