| Zacks Company Profile for Kinder Morgan, Inc. (KMI : NYSE) |

|

|

| |

| • Company Description |

| Kinder Morgan, Inc. is a midstream energy infrastructure provider in North America. The company operates pipelines to transport natural gas, crude oil, condensate, refined petroleum products, CO2 and other products. Kinder Morgan also owns terminals that are utilized for storing liquid commodities comprising ethanol & chemicals and petroleum products. The terminals also store and transload petroleum coke, metals and ores. Kinder Morgan primarily conducts business through four operating segments: Natural Gas Pipelines, Products Pipelines, Terminals and CO2. Natural Gas Pipelines: Through this business unit, the company operates key interstate and intrastate natural gas pipelines. Products Pipelines: The company transports refined petroleum products, NGL, crude and condensate to key markets. Terminals: Kinder Morgan terminals are being utilized for storing and transloading ethanol & chemicals, crude, refined petroleum products along with bulk products.

Number of Employees: 11,028 |

|

|

| |

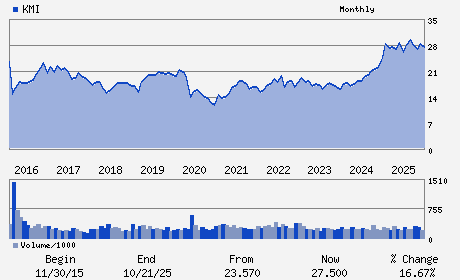

| • Price / Volume Information |

| Yesterday's Closing Price: $33.89 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 12,835,110 shares |

| Shares Outstanding: 2,224.81 (millions) |

| Market Capitalization: $75,398.69 (millions) |

| Beta: 0.68 |

| 52 Week High: $34.13 |

| 52 Week Low: $23.94 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

14.45% |

16.03% |

| 12 Week |

24.18% |

23.55% |

| Year To Date |

23.28% |

22.63% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Kimberly A. Dang - Chief Executive Officer

Richard D. Kinder - Executive Chairman

David P. Michels - Vice President and Chief Financial Officer

Amy W. Chronis - Director

Ted A. Gardner - Director

|

|

Peer Information

Kinder Morgan, Inc. (ENCC.)

Kinder Morgan, Inc. (ENGT)

Kinder Morgan, Inc. (M.PNG)

Kinder Morgan, Inc. (POCC)

Kinder Morgan, Inc. (KPP)

Kinder Morgan, Inc. (MWP)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: OIL-PROD/PIPELN

Sector: Oils/Energy

CUSIP: 49456B101

SIC: 4922

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/15/26

|

|

Share - Related Items

Shares Outstanding: 2,224.81

Most Recent Split Date: (:1)

Beta: 0.68

Market Capitalization: $75,398.69 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.45% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.36 |

Indicated Annual Dividend: $1.17 |

| Current Fiscal Year EPS Consensus Estimate: $1.36 |

Payout Ratio: 0.90 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: -0.07 |

| Estmated Long-Term EPS Growth Rate: 8.95% |

Last Dividend Paid: 02/02/2026 - $0.29 |

| Next EPS Report Date: 04/15/26 |

|

|

|

| |